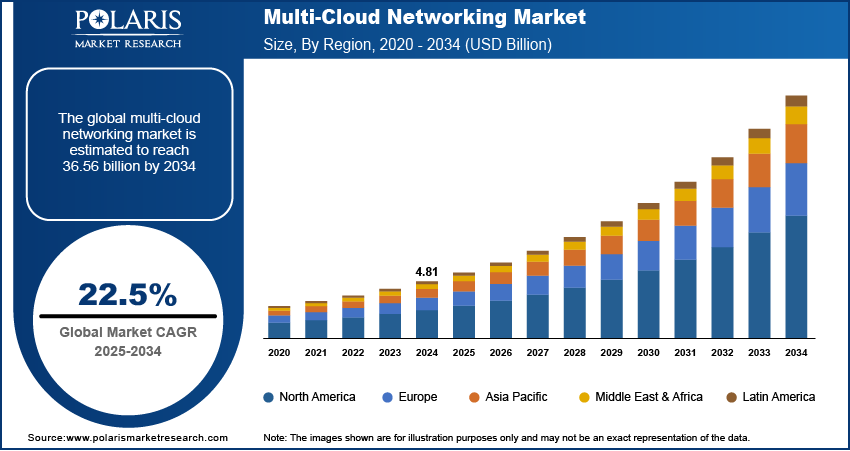

The global multi-cloud networking market, valued at USD 4.81 billion in 2024, is on a robust growth path with a projected CAGR of 22.5% from 2025 to 2034, as enterprises increasingly adopt multi-cloud environments to enhance operational resilience and avoid dependency on single vendors. This expansion is being shaped not just by macroeconomic trends but by granular shifts in segment-wise performance across product types, end-user industries, and applications. The networking solutions segment—encompassing software-defined networking (SDN), cloud interconnects, and network function virtualization (NFV)—is experiencing the most rapid adoption, driven by the need for dynamic traffic routing, policy automation, and seamless workload portability across cloud domains. Within end-user industries, financial services and healthcare are leading in adoption due to stringent regulatory requirements for data protection and business continuity, while manufacturing and retail sectors are leveraging multi-cloud networking for real-time supply chain visibility and customer engagement platforms.

Application-specific growth is particularly pronounced in AI/ML workloads, IoT data processing, and disaster recovery systems, where low-latency interconnectivity and high availability are non-negotiable. Pricing models are also evolving, with a shift from perpetual licensing to consumption-based and subscription-driven models that align with cloud economics, enabling greater scalability and cost predictability. Product differentiation is increasingly achieved through integrated security features, AI-powered analytics for network performance, and API-first architectures that facilitate third-party integrations. Enterprises are prioritizing solutions that offer value chain optimization by reducing latency, minimizing downtime, and ensuring consistent policy enforcement across hybrid environments. A critical trend is the convergence of networking and security into unified SASE (Secure Access Service Edge) frameworks, which consolidate WAN capabilities with cloud-native security functions, addressing the growing attack surface in distributed architectures.

Read More @ https://www.polarismarketresearch.com/industry-analysis/multi-cloud-networking-market

Despite these advancements, market restraints include the lack of standardized protocols across cloud providers and the skills gap in managing complex multi-cloud networks. However, opportunities abound in edge-cloud integration, where decentralized data processing demands ultra-low-latency networking, and in emerging markets where digital infrastructure is being built with multi-cloud principles from the outset. Innovation in intent-based networking, which translates business policies into automated network configurations, is further accelerating adoption. The maturation of open-source networking tools and vendor-agnostic orchestration platforms is enabling greater interoperability, reducing vendor lock-in and fostering competitive pricing. As enterprises move beyond basic cloud migration to optimize cloud operations, the focus is shifting from connectivity to intelligent networking that anticipates traffic patterns, enforces compliance, and self-heals during outages. This evolution is redefining the value proposition of multi-cloud networking from a technical enabler to a strategic business asset.

• Amazon Web Services

• Microsoft Corporation

• Google LLC

• Palo Alto Networks

• Fortinet, Inc.

• Juniper Networks

• HPE Aruba

• Citrix Systems

More Trending Latest Reports By Polaris Market Research:

Pharmaceutical Gelatin Market

Insecticides Market

Air Quality Monitoring Systems Market

Renewable Energy Certificate (REC) Market

Otoplasty Market

Cancer Contrast Media Market

Consumer Genomics Market

Food Safety Testing Market

Waste Recycling Services Market

Application-specific growth is particularly pronounced in AI/ML workloads, IoT data processing, and disaster recovery systems, where low-latency interconnectivity and high availability are non-negotiable. Pricing models are also evolving, with a shift from perpetual licensing to consumption-based and subscription-driven models that align with cloud economics, enabling greater scalability and cost predictability. Product differentiation is increasingly achieved through integrated security features, AI-powered analytics for network performance, and API-first architectures that facilitate third-party integrations. Enterprises are prioritizing solutions that offer value chain optimization by reducing latency, minimizing downtime, and ensuring consistent policy enforcement across hybrid environments. A critical trend is the convergence of networking and security into unified SASE (Secure Access Service Edge) frameworks, which consolidate WAN capabilities with cloud-native security functions, addressing the growing attack surface in distributed architectures.

Read More @ https://www.polarismarketresearch.com/industry-analysis/multi-cloud-networking-market

Despite these advancements, market restraints include the lack of standardized protocols across cloud providers and the skills gap in managing complex multi-cloud networks. However, opportunities abound in edge-cloud integration, where decentralized data processing demands ultra-low-latency networking, and in emerging markets where digital infrastructure is being built with multi-cloud principles from the outset. Innovation in intent-based networking, which translates business policies into automated network configurations, is further accelerating adoption. The maturation of open-source networking tools and vendor-agnostic orchestration platforms is enabling greater interoperability, reducing vendor lock-in and fostering competitive pricing. As enterprises move beyond basic cloud migration to optimize cloud operations, the focus is shifting from connectivity to intelligent networking that anticipates traffic patterns, enforces compliance, and self-heals during outages. This evolution is redefining the value proposition of multi-cloud networking from a technical enabler to a strategic business asset.

• Amazon Web Services

• Microsoft Corporation

• Google LLC

• Palo Alto Networks

• Fortinet, Inc.

• Juniper Networks

• HPE Aruba

• Citrix Systems

More Trending Latest Reports By Polaris Market Research:

Pharmaceutical Gelatin Market

Insecticides Market

Air Quality Monitoring Systems Market

Renewable Energy Certificate (REC) Market

Otoplasty Market

Cancer Contrast Media Market

Consumer Genomics Market

Food Safety Testing Market

Waste Recycling Services Market

The global multi-cloud networking market, valued at USD 4.81 billion in 2024, is on a robust growth path with a projected CAGR of 22.5% from 2025 to 2034, as enterprises increasingly adopt multi-cloud environments to enhance operational resilience and avoid dependency on single vendors. This expansion is being shaped not just by macroeconomic trends but by granular shifts in segment-wise performance across product types, end-user industries, and applications. The networking solutions segment—encompassing software-defined networking (SDN), cloud interconnects, and network function virtualization (NFV)—is experiencing the most rapid adoption, driven by the need for dynamic traffic routing, policy automation, and seamless workload portability across cloud domains. Within end-user industries, financial services and healthcare are leading in adoption due to stringent regulatory requirements for data protection and business continuity, while manufacturing and retail sectors are leveraging multi-cloud networking for real-time supply chain visibility and customer engagement platforms.

Application-specific growth is particularly pronounced in AI/ML workloads, IoT data processing, and disaster recovery systems, where low-latency interconnectivity and high availability are non-negotiable. Pricing models are also evolving, with a shift from perpetual licensing to consumption-based and subscription-driven models that align with cloud economics, enabling greater scalability and cost predictability. Product differentiation is increasingly achieved through integrated security features, AI-powered analytics for network performance, and API-first architectures that facilitate third-party integrations. Enterprises are prioritizing solutions that offer value chain optimization by reducing latency, minimizing downtime, and ensuring consistent policy enforcement across hybrid environments. A critical trend is the convergence of networking and security into unified SASE (Secure Access Service Edge) frameworks, which consolidate WAN capabilities with cloud-native security functions, addressing the growing attack surface in distributed architectures.

Read More @ https://www.polarismarketresearch.com/industry-analysis/multi-cloud-networking-market

Despite these advancements, market restraints include the lack of standardized protocols across cloud providers and the skills gap in managing complex multi-cloud networks. However, opportunities abound in edge-cloud integration, where decentralized data processing demands ultra-low-latency networking, and in emerging markets where digital infrastructure is being built with multi-cloud principles from the outset. Innovation in intent-based networking, which translates business policies into automated network configurations, is further accelerating adoption. The maturation of open-source networking tools and vendor-agnostic orchestration platforms is enabling greater interoperability, reducing vendor lock-in and fostering competitive pricing. As enterprises move beyond basic cloud migration to optimize cloud operations, the focus is shifting from connectivity to intelligent networking that anticipates traffic patterns, enforces compliance, and self-heals during outages. This evolution is redefining the value proposition of multi-cloud networking from a technical enabler to a strategic business asset.

• Amazon Web Services

• Microsoft Corporation

• Google LLC

• Palo Alto Networks

• Fortinet, Inc.

• Juniper Networks

• HPE Aruba

• Citrix Systems

More Trending Latest Reports By Polaris Market Research:

Pharmaceutical Gelatin Market

Insecticides Market

Air Quality Monitoring Systems Market

Renewable Energy Certificate (REC) Market

Otoplasty Market

Cancer Contrast Media Market

Consumer Genomics Market

Food Safety Testing Market

Waste Recycling Services Market

0 التعليقات

·0 المشاركات

·7 مشاهدة

·0 معاينة