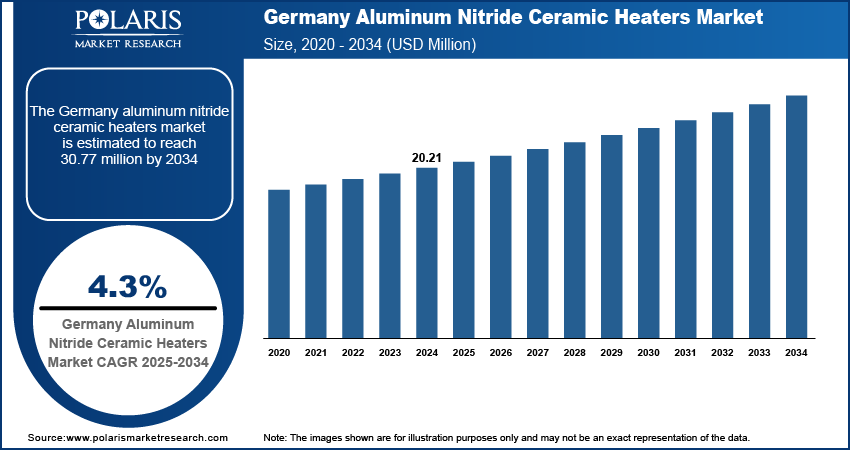

The Germany aluminum nitride ceramic heaters market, valued at USD 20.21 million in 2024, is expected to grow at a CAGR of 4.3% from 2025 to 2034, with Germany emerging as a pivotal player in the European high-performance ceramics ecosystem due to its strong industrial base, R&D leadership, and integration into global technology supply chains. While the U.S. and Japan lead in raw material production and large-scale semiconductor equipment, Germany’s strategic positioning lies in precision engineering, system integration, and advanced manufacturing know-how. National policy impact is evident through federal support for the “Industrie 4.0” initiative and funding from the Federal Ministry of Education and Research (BMBF) for projects in next-generation materials and clean energy technologies.

These policies are accelerating demand for AlN ceramic heaters in applications ranging from hydrogen electrolysis stacks to quantum computing cryogenic systems. Market share concentration remains moderate, with CeramTec GmbH holding the largest domestic position, followed by subsidiaries of Japanese and American multinationals such as Kyocera, NGK, and Morgan Advanced Materials. R&D leadership is centered in innovation hubs such as Karlsruhe, Dresden, and the Fraunhofer Society network, where materials scientists are advancing sintering additives, nanostructuring techniques, and additive manufacturing of AlN components to improve thermal performance and reduce production costs.

Read More @ https://www.polarismarketresearch.com/industry-analysis/germany-aluminum-nitride-ceramic-heater-market

Local manufacturing bases in Germany are focused on high-value processing stages—such as metallization, brazing, and final assembly—rather than raw powder synthesis, which remains concentrated in Japan and China. This creates a strategic dependency, but one that German firms are mitigating through long-term supply agreements and joint development programs with Asian material suppliers. Trade policies, including EU export controls on dual-use technologies and Germany’s adherence to CO2 pricing under the EU Emissions Trading System (ETS), are influencing both procurement and product design, pushing manufacturers toward energy-efficient, long-life components. Corporate strategies reflect this environment: CeramTec’s acquisition of specialized thermal systems divisions and partnerships with semiconductor OEMs demonstrate a focus on vertical integration and application-specific engineering.

Strategic positioning is further enhanced by Germany’s role in the European semiconductor resurgence, with the expansion of fabs in Dresden (GlobalFoundries, Bosch) and future Intel facilities driving local demand for high-performance process components. As global competition intensifies, the ability to align with national innovation agendas, deliver technically differentiated products, and ensure supply chain resilience will determine long-term market success.

These policies are accelerating demand for AlN ceramic heaters in applications ranging from hydrogen electrolysis stacks to quantum computing cryogenic systems. Market share concentration remains moderate, with CeramTec GmbH holding the largest domestic position, followed by subsidiaries of Japanese and American multinationals such as Kyocera, NGK, and Morgan Advanced Materials. R&D leadership is centered in innovation hubs such as Karlsruhe, Dresden, and the Fraunhofer Society network, where materials scientists are advancing sintering additives, nanostructuring techniques, and additive manufacturing of AlN components to improve thermal performance and reduce production costs.

Read More @ https://www.polarismarketresearch.com/industry-analysis/germany-aluminum-nitride-ceramic-heater-market

Local manufacturing bases in Germany are focused on high-value processing stages—such as metallization, brazing, and final assembly—rather than raw powder synthesis, which remains concentrated in Japan and China. This creates a strategic dependency, but one that German firms are mitigating through long-term supply agreements and joint development programs with Asian material suppliers. Trade policies, including EU export controls on dual-use technologies and Germany’s adherence to CO2 pricing under the EU Emissions Trading System (ETS), are influencing both procurement and product design, pushing manufacturers toward energy-efficient, long-life components. Corporate strategies reflect this environment: CeramTec’s acquisition of specialized thermal systems divisions and partnerships with semiconductor OEMs demonstrate a focus on vertical integration and application-specific engineering.

Strategic positioning is further enhanced by Germany’s role in the European semiconductor resurgence, with the expansion of fabs in Dresden (GlobalFoundries, Bosch) and future Intel facilities driving local demand for high-performance process components. As global competition intensifies, the ability to align with national innovation agendas, deliver technically differentiated products, and ensure supply chain resilience will determine long-term market success.

The Germany aluminum nitride ceramic heaters market, valued at USD 20.21 million in 2024, is expected to grow at a CAGR of 4.3% from 2025 to 2034, with Germany emerging as a pivotal player in the European high-performance ceramics ecosystem due to its strong industrial base, R&D leadership, and integration into global technology supply chains. While the U.S. and Japan lead in raw material production and large-scale semiconductor equipment, Germany’s strategic positioning lies in precision engineering, system integration, and advanced manufacturing know-how. National policy impact is evident through federal support for the “Industrie 4.0” initiative and funding from the Federal Ministry of Education and Research (BMBF) for projects in next-generation materials and clean energy technologies.

These policies are accelerating demand for AlN ceramic heaters in applications ranging from hydrogen electrolysis stacks to quantum computing cryogenic systems. Market share concentration remains moderate, with CeramTec GmbH holding the largest domestic position, followed by subsidiaries of Japanese and American multinationals such as Kyocera, NGK, and Morgan Advanced Materials. R&D leadership is centered in innovation hubs such as Karlsruhe, Dresden, and the Fraunhofer Society network, where materials scientists are advancing sintering additives, nanostructuring techniques, and additive manufacturing of AlN components to improve thermal performance and reduce production costs.

Read More @ https://www.polarismarketresearch.com/industry-analysis/germany-aluminum-nitride-ceramic-heater-market

Local manufacturing bases in Germany are focused on high-value processing stages—such as metallization, brazing, and final assembly—rather than raw powder synthesis, which remains concentrated in Japan and China. This creates a strategic dependency, but one that German firms are mitigating through long-term supply agreements and joint development programs with Asian material suppliers. Trade policies, including EU export controls on dual-use technologies and Germany’s adherence to CO2 pricing under the EU Emissions Trading System (ETS), are influencing both procurement and product design, pushing manufacturers toward energy-efficient, long-life components. Corporate strategies reflect this environment: CeramTec’s acquisition of specialized thermal systems divisions and partnerships with semiconductor OEMs demonstrate a focus on vertical integration and application-specific engineering.

Strategic positioning is further enhanced by Germany’s role in the European semiconductor resurgence, with the expansion of fabs in Dresden (GlobalFoundries, Bosch) and future Intel facilities driving local demand for high-performance process components. As global competition intensifies, the ability to align with national innovation agendas, deliver technically differentiated products, and ensure supply chain resilience will determine long-term market success.

0 Commenti

·0 condivisioni

·7 Views

·0 Anteprima