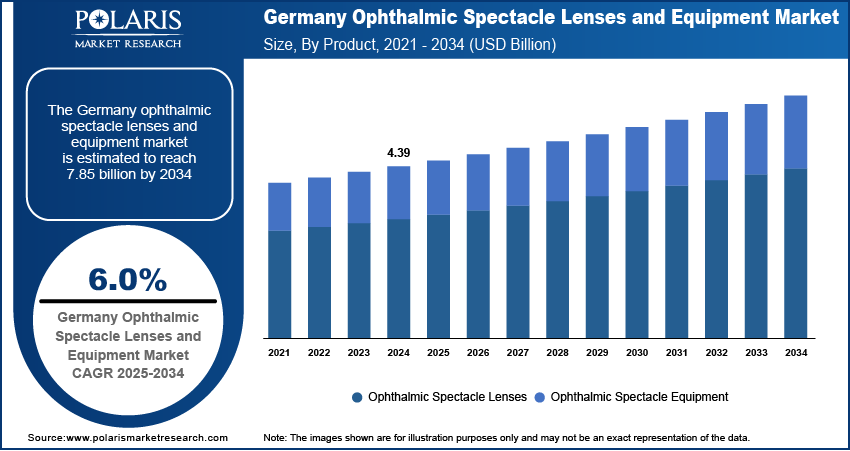

The Germany ophthalmic spectacle lenses and equipment market, valued at USD 4.39 billion in 2024 and projected to grow at a 6.0% CAGR through 2034, reflects the country’s pivotal role in shaping global vision care standards through innovation, regulatory influence, and industrial excellence. As one of the top three ophthalmic markets in Europe—alongside France and the UK—Germany benefits from a highly skilled workforce, a dense network of research institutions, and strong national policy impact that prioritizes healthcare quality and technological advancement. The Federal Institute for Drugs and Medical Devices (BfArM) enforces rigorous compliance standards, ensuring that both domestic and imported products meet high safety and performance benchmarks, thereby reinforcing consumer confidence and market integrity.

Germany’s leadership is further amplified by its status as a global hub for R&D leadership in optical engineering, with companies like Carl Zeiss Vision and Rodenstock investing heavily in material science, digital lens design, and AI-driven diagnostics. These firms operate innovation centers in collaboration with universities and Fraunhofer institutes, accelerating the development of high-index, lightweight lenses and smart eyewear prototypes. The country’s local manufacturing bases in Bavaria and Rhineland are supported by a robust supply chain of precision tooling and coating specialists, enabling rapid prototyping and scalable production. This ecosystem gives German manufacturers a distinct tech advantage in producing complex, high-precision lenses that are difficult to replicate in low-cost regions.

Read More @ https://www.polarismarketresearch.com/industry-analysis/germany-ophthalmic-spectacle-lenses-and-equipment-market

Strategic positioning is evident in corporate expansion strategies, where German firms are leveraging their reputation for quality to penetrate high-growth markets in Asia and Eastern Europe. EssilorLuxottica’s acquisition of a controlling stake in Rodenstock in 2021 exemplifies market share concentration, allowing for greater economies of scale and enhanced distribution reach. Similarly, Zeiss has expanded its digital eye care platforms into China and India, where rising middle-class demand for premium vision solutions is creating new revenue streams. These moves are supported by favorable trade policies within the EU single market, which facilitate cross-border equipment sales and service integration.

Germany’s leadership is further amplified by its status as a global hub for R&D leadership in optical engineering, with companies like Carl Zeiss Vision and Rodenstock investing heavily in material science, digital lens design, and AI-driven diagnostics. These firms operate innovation centers in collaboration with universities and Fraunhofer institutes, accelerating the development of high-index, lightweight lenses and smart eyewear prototypes. The country’s local manufacturing bases in Bavaria and Rhineland are supported by a robust supply chain of precision tooling and coating specialists, enabling rapid prototyping and scalable production. This ecosystem gives German manufacturers a distinct tech advantage in producing complex, high-precision lenses that are difficult to replicate in low-cost regions.

Read More @ https://www.polarismarketresearch.com/industry-analysis/germany-ophthalmic-spectacle-lenses-and-equipment-market

Strategic positioning is evident in corporate expansion strategies, where German firms are leveraging their reputation for quality to penetrate high-growth markets in Asia and Eastern Europe. EssilorLuxottica’s acquisition of a controlling stake in Rodenstock in 2021 exemplifies market share concentration, allowing for greater economies of scale and enhanced distribution reach. Similarly, Zeiss has expanded its digital eye care platforms into China and India, where rising middle-class demand for premium vision solutions is creating new revenue streams. These moves are supported by favorable trade policies within the EU single market, which facilitate cross-border equipment sales and service integration.

The Germany ophthalmic spectacle lenses and equipment market, valued at USD 4.39 billion in 2024 and projected to grow at a 6.0% CAGR through 2034, reflects the country’s pivotal role in shaping global vision care standards through innovation, regulatory influence, and industrial excellence. As one of the top three ophthalmic markets in Europe—alongside France and the UK—Germany benefits from a highly skilled workforce, a dense network of research institutions, and strong national policy impact that prioritizes healthcare quality and technological advancement. The Federal Institute for Drugs and Medical Devices (BfArM) enforces rigorous compliance standards, ensuring that both domestic and imported products meet high safety and performance benchmarks, thereby reinforcing consumer confidence and market integrity.

Germany’s leadership is further amplified by its status as a global hub for R&D leadership in optical engineering, with companies like Carl Zeiss Vision and Rodenstock investing heavily in material science, digital lens design, and AI-driven diagnostics. These firms operate innovation centers in collaboration with universities and Fraunhofer institutes, accelerating the development of high-index, lightweight lenses and smart eyewear prototypes. The country’s local manufacturing bases in Bavaria and Rhineland are supported by a robust supply chain of precision tooling and coating specialists, enabling rapid prototyping and scalable production. This ecosystem gives German manufacturers a distinct tech advantage in producing complex, high-precision lenses that are difficult to replicate in low-cost regions.

Read More @ https://www.polarismarketresearch.com/industry-analysis/germany-ophthalmic-spectacle-lenses-and-equipment-market

Strategic positioning is evident in corporate expansion strategies, where German firms are leveraging their reputation for quality to penetrate high-growth markets in Asia and Eastern Europe. EssilorLuxottica’s acquisition of a controlling stake in Rodenstock in 2021 exemplifies market share concentration, allowing for greater economies of scale and enhanced distribution reach. Similarly, Zeiss has expanded its digital eye care platforms into China and India, where rising middle-class demand for premium vision solutions is creating new revenue streams. These moves are supported by favorable trade policies within the EU single market, which facilitate cross-border equipment sales and service integration.

0 Commenti

·0 condivisioni

·3 Views

·0 Anteprima