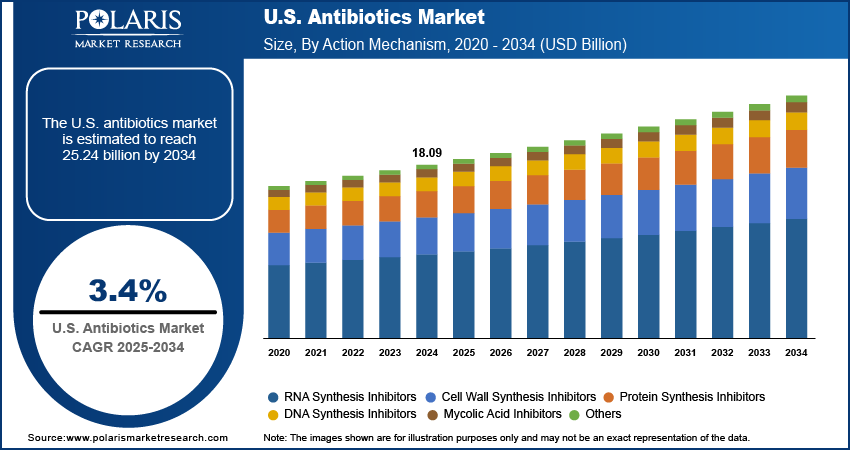

The U.S. antibiotics market, valued at USD 18.09 billion in 2024, is projected to grow at a compound annual growth rate (CAGR) of 3.4% from 2025 to 2034, driven by rising bacterial resistance, increased hospital admissions, and ongoing public health investments in antimicrobial stewardship. While this report focuses on the U.S. market, its trajectory cannot be analyzed in isolation, as global dynamics in regulatory policy, supply chain resilience, and regional manufacturing trends significantly influence domestic availability and pricing. North America, led by the United States, maintains a dominant position in antibiotic consumption and innovation, supported by a robust healthcare infrastructure, high physician prescribing rates, and substantial federal funding for infectious disease research.

However, the region faces mounting pressure from the Centers for Disease Control and Prevention (CDC) and the Food and Drug Administration (FDA) to curb inappropriate antibiotic use and accelerate the development of novel agents to combat multidrug-resistant organisms (MDROs). In contrast, Europe’s approach is shaped by the European Centre for Disease Prevention and Control (ECDC) and stringent EU-wide antimicrobial resistance (AMR) action plans, which emphasize surveillance, hospital-based stewardship programs, and restrictions on agricultural antibiotic use—factors that have led to lower per capita consumption compared to the U.S. This regulatory divergence affects global market penetration strategies, as multinational pharmaceutical companies must tailor product launches, labeling, and promotional activities to comply with region-specific guidelines.

Meanwhile, the Asia Pacific region, particularly India and China, plays a critical role in the global antibiotics value chain as primary manufacturers of active pharmaceutical ingredients (APIs). Over 80% of the APIs used in U.S.-marketed antibiotics are sourced from facilities in these countries, making cross-border supply chains a strategic vulnerability. Geopolitical tensions, trade restrictions, and pandemic-era disruptions have exposed the fragility of this dependency, prompting the U.S. Department of Health and Human Services (HHS) and the Biden administration to initiate programs like the Strengthening America’s Pharmaceutical Supply Chain initiative, aimed at onshoring critical production. Regional manufacturing trends now include public-private partnerships to rebuild domestic API capacity, particularly for essential antibiotics such as penicillins, cephalosporins, and carbapenems.

Read More @ https://www.polarismarketresearch.com/industry-analysis/us-antibiotics-market

These efforts are further supported by the Creating and Restoring Equal Access to Equivalent Samples (CREATES) Act, which aims to prevent anti-competitive practices that delay generic entry. As a result, market dynamics are shifting from pure volume-driven growth to a model emphasizing supply security, quality assurance, and compliance with Good Manufacturing Practices (GMP). The competitive landscape reflects this complex interplay of regulation, sourcing, and innovation, with companies investing in dual-sourcing strategies and advanced manufacturing technologies like continuous flow synthesis to enhance resilience and reduce costs.

Key market drivers include the rising prevalence of hospital-acquired infections (HAIs), the growing elderly population, and the resurgence of community-acquired pneumonia and skin infections. However, restraints such as stringent FDA approval pathways for new antibiotics, low reimbursement rates, and the economic disincentive for pharmaceutical companies to invest in anti-infectives—due to stewardship-driven limited use—continue to stifle innovation. Opportunities are emerging through public funding mechanisms like the Pioneering Antimicrobial Subscriptions to End Upsurging Resistance (PASTEUR) Act, which proposes subscription-based payments for novel antibiotics, decoupling revenue from volume and incentivizing R&D.

However, the region faces mounting pressure from the Centers for Disease Control and Prevention (CDC) and the Food and Drug Administration (FDA) to curb inappropriate antibiotic use and accelerate the development of novel agents to combat multidrug-resistant organisms (MDROs). In contrast, Europe’s approach is shaped by the European Centre for Disease Prevention and Control (ECDC) and stringent EU-wide antimicrobial resistance (AMR) action plans, which emphasize surveillance, hospital-based stewardship programs, and restrictions on agricultural antibiotic use—factors that have led to lower per capita consumption compared to the U.S. This regulatory divergence affects global market penetration strategies, as multinational pharmaceutical companies must tailor product launches, labeling, and promotional activities to comply with region-specific guidelines.

Meanwhile, the Asia Pacific region, particularly India and China, plays a critical role in the global antibiotics value chain as primary manufacturers of active pharmaceutical ingredients (APIs). Over 80% of the APIs used in U.S.-marketed antibiotics are sourced from facilities in these countries, making cross-border supply chains a strategic vulnerability. Geopolitical tensions, trade restrictions, and pandemic-era disruptions have exposed the fragility of this dependency, prompting the U.S. Department of Health and Human Services (HHS) and the Biden administration to initiate programs like the Strengthening America’s Pharmaceutical Supply Chain initiative, aimed at onshoring critical production. Regional manufacturing trends now include public-private partnerships to rebuild domestic API capacity, particularly for essential antibiotics such as penicillins, cephalosporins, and carbapenems.

Read More @ https://www.polarismarketresearch.com/industry-analysis/us-antibiotics-market

These efforts are further supported by the Creating and Restoring Equal Access to Equivalent Samples (CREATES) Act, which aims to prevent anti-competitive practices that delay generic entry. As a result, market dynamics are shifting from pure volume-driven growth to a model emphasizing supply security, quality assurance, and compliance with Good Manufacturing Practices (GMP). The competitive landscape reflects this complex interplay of regulation, sourcing, and innovation, with companies investing in dual-sourcing strategies and advanced manufacturing technologies like continuous flow synthesis to enhance resilience and reduce costs.

Key market drivers include the rising prevalence of hospital-acquired infections (HAIs), the growing elderly population, and the resurgence of community-acquired pneumonia and skin infections. However, restraints such as stringent FDA approval pathways for new antibiotics, low reimbursement rates, and the economic disincentive for pharmaceutical companies to invest in anti-infectives—due to stewardship-driven limited use—continue to stifle innovation. Opportunities are emerging through public funding mechanisms like the Pioneering Antimicrobial Subscriptions to End Upsurging Resistance (PASTEUR) Act, which proposes subscription-based payments for novel antibiotics, decoupling revenue from volume and incentivizing R&D.

The U.S. antibiotics market, valued at USD 18.09 billion in 2024, is projected to grow at a compound annual growth rate (CAGR) of 3.4% from 2025 to 2034, driven by rising bacterial resistance, increased hospital admissions, and ongoing public health investments in antimicrobial stewardship. While this report focuses on the U.S. market, its trajectory cannot be analyzed in isolation, as global dynamics in regulatory policy, supply chain resilience, and regional manufacturing trends significantly influence domestic availability and pricing. North America, led by the United States, maintains a dominant position in antibiotic consumption and innovation, supported by a robust healthcare infrastructure, high physician prescribing rates, and substantial federal funding for infectious disease research.

However, the region faces mounting pressure from the Centers for Disease Control and Prevention (CDC) and the Food and Drug Administration (FDA) to curb inappropriate antibiotic use and accelerate the development of novel agents to combat multidrug-resistant organisms (MDROs). In contrast, Europe’s approach is shaped by the European Centre for Disease Prevention and Control (ECDC) and stringent EU-wide antimicrobial resistance (AMR) action plans, which emphasize surveillance, hospital-based stewardship programs, and restrictions on agricultural antibiotic use—factors that have led to lower per capita consumption compared to the U.S. This regulatory divergence affects global market penetration strategies, as multinational pharmaceutical companies must tailor product launches, labeling, and promotional activities to comply with region-specific guidelines.

Meanwhile, the Asia Pacific region, particularly India and China, plays a critical role in the global antibiotics value chain as primary manufacturers of active pharmaceutical ingredients (APIs). Over 80% of the APIs used in U.S.-marketed antibiotics are sourced from facilities in these countries, making cross-border supply chains a strategic vulnerability. Geopolitical tensions, trade restrictions, and pandemic-era disruptions have exposed the fragility of this dependency, prompting the U.S. Department of Health and Human Services (HHS) and the Biden administration to initiate programs like the Strengthening America’s Pharmaceutical Supply Chain initiative, aimed at onshoring critical production. Regional manufacturing trends now include public-private partnerships to rebuild domestic API capacity, particularly for essential antibiotics such as penicillins, cephalosporins, and carbapenems.

Read More @ https://www.polarismarketresearch.com/industry-analysis/us-antibiotics-market

These efforts are further supported by the Creating and Restoring Equal Access to Equivalent Samples (CREATES) Act, which aims to prevent anti-competitive practices that delay generic entry. As a result, market dynamics are shifting from pure volume-driven growth to a model emphasizing supply security, quality assurance, and compliance with Good Manufacturing Practices (GMP). The competitive landscape reflects this complex interplay of regulation, sourcing, and innovation, with companies investing in dual-sourcing strategies and advanced manufacturing technologies like continuous flow synthesis to enhance resilience and reduce costs.

Key market drivers include the rising prevalence of hospital-acquired infections (HAIs), the growing elderly population, and the resurgence of community-acquired pneumonia and skin infections. However, restraints such as stringent FDA approval pathways for new antibiotics, low reimbursement rates, and the economic disincentive for pharmaceutical companies to invest in anti-infectives—due to stewardship-driven limited use—continue to stifle innovation. Opportunities are emerging through public funding mechanisms like the Pioneering Antimicrobial Subscriptions to End Upsurging Resistance (PASTEUR) Act, which proposes subscription-based payments for novel antibiotics, decoupling revenue from volume and incentivizing R&D.

0 Comments

·0 Shares

·6 Views

·0 Reviews