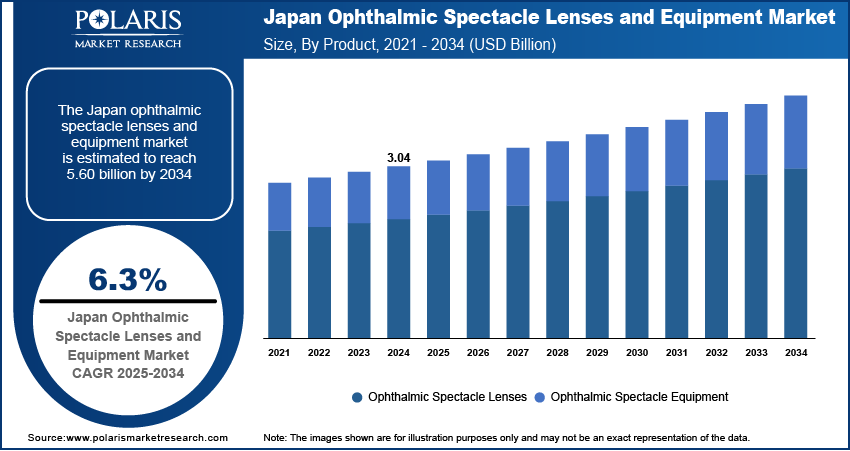

The Japan ophthalmic spectacle lenses and equipment market, valued at USD 3.04 billion in 2024 and projected to grow at a 6.3% CAGR through 2034, reflects the country’s strategic positioning as a global leader in optical innovation, driven by strong national policy impact, R&D leadership, and deep integration into international healthcare ecosystems. Japan ranks among the top five global markets for ophthalmic devices, alongside the U.S., Germany, China, and France, benefiting from a highly skilled workforce, advanced manufacturing capabilities, and government-backed initiatives that promote technological self-reliance. The Society 5.0 initiative, launched by the Cabinet Office, emphasizes the fusion of physical and digital technologies, directly influencing R&D investments in smart lenses, AI-driven diagnostics, and tele-optometry platforms. This national policy impact is reinforced by the Ministry of Economy, Trade and Industry (METI), which provides grants and tax incentives for companies developing next-generation medical devices.

Japan’s local manufacturing bases in Kanagawa, Osaka, and Aichi are home to innovation hubs where firms like Hoya, Topcon, and Nikon-Essilor conduct cutting-edge research in high-index lens materials, anti-reflective coatings, and digital surfacing technologies. These clusters benefit from close collaboration with academic institutions such as the University of Tokyo and Kyoto University, enabling rapid translation of scientific discoveries into commercial products. The country’s emphasis on precision engineering and quality control gives it a distinct tech advantage in producing complex, high-performance lenses that are difficult to replicate in low-cost manufacturing regions. Market share concentration is evident in the dominance of Hoya and Nikon-Essilor, which together control over 50% of the domestic spectacle lens market, leveraging economies of scale and extensive distribution networks.

Read More @ https://www.polarismarketresearch.com/industry-analysis/japan-ophthalmic-spectacle-lenses-and-equipment-market

Strategic positioning is further enhanced by corporate expansions and international partnerships. Hoya’s acquisition of Solamer, a U.S.-based lens coating specialist, strengthened its global footprint and enhanced its anti-reflective technology portfolio. Similarly, Topcon has expanded into AI-powered retinal imaging through collaborations with cloud diagnostics firms, positioning itself at the forefront of digital eye care. These moves reflect a broader trend of market consolidation, where scale and technological differentiation determine long-term competitiveness. Trade policies within the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) also facilitate smoother export of ophthalmic equipment to Canada, Australia, and Mexico, reducing tariffs and regulatory barriers.

Japan’s local manufacturing bases in Kanagawa, Osaka, and Aichi are home to innovation hubs where firms like Hoya, Topcon, and Nikon-Essilor conduct cutting-edge research in high-index lens materials, anti-reflective coatings, and digital surfacing technologies. These clusters benefit from close collaboration with academic institutions such as the University of Tokyo and Kyoto University, enabling rapid translation of scientific discoveries into commercial products. The country’s emphasis on precision engineering and quality control gives it a distinct tech advantage in producing complex, high-performance lenses that are difficult to replicate in low-cost manufacturing regions. Market share concentration is evident in the dominance of Hoya and Nikon-Essilor, which together control over 50% of the domestic spectacle lens market, leveraging economies of scale and extensive distribution networks.

Read More @ https://www.polarismarketresearch.com/industry-analysis/japan-ophthalmic-spectacle-lenses-and-equipment-market

Strategic positioning is further enhanced by corporate expansions and international partnerships. Hoya’s acquisition of Solamer, a U.S.-based lens coating specialist, strengthened its global footprint and enhanced its anti-reflective technology portfolio. Similarly, Topcon has expanded into AI-powered retinal imaging through collaborations with cloud diagnostics firms, positioning itself at the forefront of digital eye care. These moves reflect a broader trend of market consolidation, where scale and technological differentiation determine long-term competitiveness. Trade policies within the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) also facilitate smoother export of ophthalmic equipment to Canada, Australia, and Mexico, reducing tariffs and regulatory barriers.

The Japan ophthalmic spectacle lenses and equipment market, valued at USD 3.04 billion in 2024 and projected to grow at a 6.3% CAGR through 2034, reflects the country’s strategic positioning as a global leader in optical innovation, driven by strong national policy impact, R&D leadership, and deep integration into international healthcare ecosystems. Japan ranks among the top five global markets for ophthalmic devices, alongside the U.S., Germany, China, and France, benefiting from a highly skilled workforce, advanced manufacturing capabilities, and government-backed initiatives that promote technological self-reliance. The Society 5.0 initiative, launched by the Cabinet Office, emphasizes the fusion of physical and digital technologies, directly influencing R&D investments in smart lenses, AI-driven diagnostics, and tele-optometry platforms. This national policy impact is reinforced by the Ministry of Economy, Trade and Industry (METI), which provides grants and tax incentives for companies developing next-generation medical devices.

Japan’s local manufacturing bases in Kanagawa, Osaka, and Aichi are home to innovation hubs where firms like Hoya, Topcon, and Nikon-Essilor conduct cutting-edge research in high-index lens materials, anti-reflective coatings, and digital surfacing technologies. These clusters benefit from close collaboration with academic institutions such as the University of Tokyo and Kyoto University, enabling rapid translation of scientific discoveries into commercial products. The country’s emphasis on precision engineering and quality control gives it a distinct tech advantage in producing complex, high-performance lenses that are difficult to replicate in low-cost manufacturing regions. Market share concentration is evident in the dominance of Hoya and Nikon-Essilor, which together control over 50% of the domestic spectacle lens market, leveraging economies of scale and extensive distribution networks.

Read More @ https://www.polarismarketresearch.com/industry-analysis/japan-ophthalmic-spectacle-lenses-and-equipment-market

Strategic positioning is further enhanced by corporate expansions and international partnerships. Hoya’s acquisition of Solamer, a U.S.-based lens coating specialist, strengthened its global footprint and enhanced its anti-reflective technology portfolio. Similarly, Topcon has expanded into AI-powered retinal imaging through collaborations with cloud diagnostics firms, positioning itself at the forefront of digital eye care. These moves reflect a broader trend of market consolidation, where scale and technological differentiation determine long-term competitiveness. Trade policies within the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) also facilitate smoother export of ophthalmic equipment to Canada, Australia, and Mexico, reducing tariffs and regulatory barriers.

0 Commenti

·0 condivisioni

·2 Views

·0 Anteprima