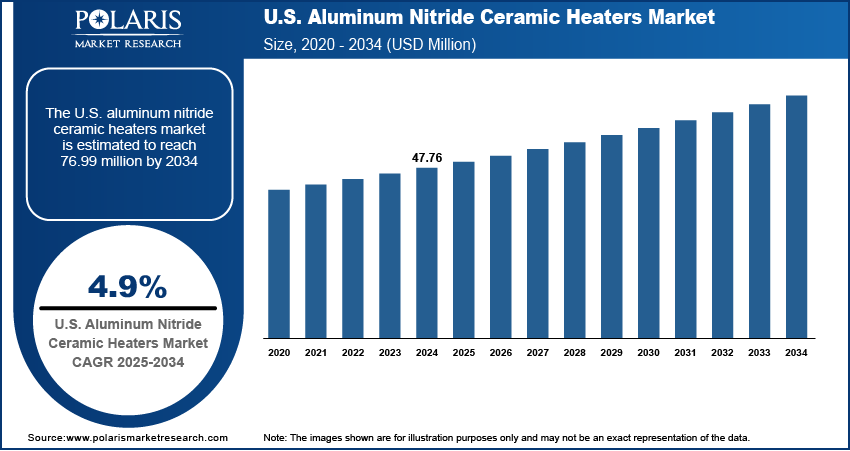

The U.S. aluminum nitride ceramic heaters market, valued at USD 47.76 million in 2024, is expected to grow at a CAGR of 4.9% from 2025 to 2034, with the United States maintaining a leading position in technological innovation and application integration, despite significant production and material sourcing dependencies on Japan and Europe. The U.S. market’s trajectory is heavily influenced by national policy impact, particularly through federal initiatives such as the CHIPS and Science Act and the Department of Energy’s Advanced Manufacturing Office, both of which support the development of critical materials and components for semiconductor and clean energy systems. These policies are accelerating domestic demand for high-performance thermal management solutions, positioning AlN ceramic heaters as strategic components in next-generation fabrication tools.

Market share concentration remains moderate, with no single player dominating the fragmented landscape, though U.S.-based Morgan Advanced Materials and subsidiaries of German CeramTec and Japanese NGK Spark Plug hold substantial influence. R&D leadership is concentrated in innovation hubs such as Boston, Research Triangle Park, and Silicon Valley, where materials scientists and engineers are advancing sintering techniques, doping methods, and multilayer co-firing processes to improve thermal conductivity and mechanical reliability. Local manufacturing bases in the U.S. are expanding, but remain limited by the scarcity of high-purity aluminum nitride powder, which is predominantly produced in Japan by Tokuyama and China’s Saint-Gobain (formerly Blasch), creating a strategic vulnerability.

Trade policies, including Section 301 tariffs and export controls on dual-use technologies, are reshaping procurement strategies, prompting American firms to diversify suppliers and explore alternative synthesis routes, such as carbothermal reduction-nitridation, to reduce reliance on foreign sources. Strategic positioning is further enhanced by corporate investments in vertical integration: CeramTec’s acquisition of certain Morgan thermal systems operations and Kyocera’s expansion into semiconductor components reflect a broader trend of consolidation to capture more value chain segments.

Read More @ https://www.polarismarketresearch.com/industry-analysis/us-aluminum-nitride-ceramic-heater-market

Companies are also focusing on application-specific engineering, developing heaters tailored for extreme environments in aerospace, defense, and nuclear fusion research, where thermal stability and radiation resistance are paramount. R&D leadership is evident in collaborative projects funded by DARPA and NIST, which are exploring nanostructured AlN composites and additive manufacturing techniques to produce complex heater geometries with improved performance. As global competition intensifies, the ability to align with national security priorities, deliver technically differentiated products, and ensure supply chain resilience will determine long-term market success.

Market share concentration remains moderate, with no single player dominating the fragmented landscape, though U.S.-based Morgan Advanced Materials and subsidiaries of German CeramTec and Japanese NGK Spark Plug hold substantial influence. R&D leadership is concentrated in innovation hubs such as Boston, Research Triangle Park, and Silicon Valley, where materials scientists and engineers are advancing sintering techniques, doping methods, and multilayer co-firing processes to improve thermal conductivity and mechanical reliability. Local manufacturing bases in the U.S. are expanding, but remain limited by the scarcity of high-purity aluminum nitride powder, which is predominantly produced in Japan by Tokuyama and China’s Saint-Gobain (formerly Blasch), creating a strategic vulnerability.

Trade policies, including Section 301 tariffs and export controls on dual-use technologies, are reshaping procurement strategies, prompting American firms to diversify suppliers and explore alternative synthesis routes, such as carbothermal reduction-nitridation, to reduce reliance on foreign sources. Strategic positioning is further enhanced by corporate investments in vertical integration: CeramTec’s acquisition of certain Morgan thermal systems operations and Kyocera’s expansion into semiconductor components reflect a broader trend of consolidation to capture more value chain segments.

Read More @ https://www.polarismarketresearch.com/industry-analysis/us-aluminum-nitride-ceramic-heater-market

Companies are also focusing on application-specific engineering, developing heaters tailored for extreme environments in aerospace, defense, and nuclear fusion research, where thermal stability and radiation resistance are paramount. R&D leadership is evident in collaborative projects funded by DARPA and NIST, which are exploring nanostructured AlN composites and additive manufacturing techniques to produce complex heater geometries with improved performance. As global competition intensifies, the ability to align with national security priorities, deliver technically differentiated products, and ensure supply chain resilience will determine long-term market success.

The U.S. aluminum nitride ceramic heaters market, valued at USD 47.76 million in 2024, is expected to grow at a CAGR of 4.9% from 2025 to 2034, with the United States maintaining a leading position in technological innovation and application integration, despite significant production and material sourcing dependencies on Japan and Europe. The U.S. market’s trajectory is heavily influenced by national policy impact, particularly through federal initiatives such as the CHIPS and Science Act and the Department of Energy’s Advanced Manufacturing Office, both of which support the development of critical materials and components for semiconductor and clean energy systems. These policies are accelerating domestic demand for high-performance thermal management solutions, positioning AlN ceramic heaters as strategic components in next-generation fabrication tools.

Market share concentration remains moderate, with no single player dominating the fragmented landscape, though U.S.-based Morgan Advanced Materials and subsidiaries of German CeramTec and Japanese NGK Spark Plug hold substantial influence. R&D leadership is concentrated in innovation hubs such as Boston, Research Triangle Park, and Silicon Valley, where materials scientists and engineers are advancing sintering techniques, doping methods, and multilayer co-firing processes to improve thermal conductivity and mechanical reliability. Local manufacturing bases in the U.S. are expanding, but remain limited by the scarcity of high-purity aluminum nitride powder, which is predominantly produced in Japan by Tokuyama and China’s Saint-Gobain (formerly Blasch), creating a strategic vulnerability.

Trade policies, including Section 301 tariffs and export controls on dual-use technologies, are reshaping procurement strategies, prompting American firms to diversify suppliers and explore alternative synthesis routes, such as carbothermal reduction-nitridation, to reduce reliance on foreign sources. Strategic positioning is further enhanced by corporate investments in vertical integration: CeramTec’s acquisition of certain Morgan thermal systems operations and Kyocera’s expansion into semiconductor components reflect a broader trend of consolidation to capture more value chain segments.

Read More @ https://www.polarismarketresearch.com/industry-analysis/us-aluminum-nitride-ceramic-heater-market

Companies are also focusing on application-specific engineering, developing heaters tailored for extreme environments in aerospace, defense, and nuclear fusion research, where thermal stability and radiation resistance are paramount. R&D leadership is evident in collaborative projects funded by DARPA and NIST, which are exploring nanostructured AlN composites and additive manufacturing techniques to produce complex heater geometries with improved performance. As global competition intensifies, the ability to align with national security priorities, deliver technically differentiated products, and ensure supply chain resilience will determine long-term market success.

0 Commenti

·0 condivisioni

·7 Views

·0 Anteprima