-

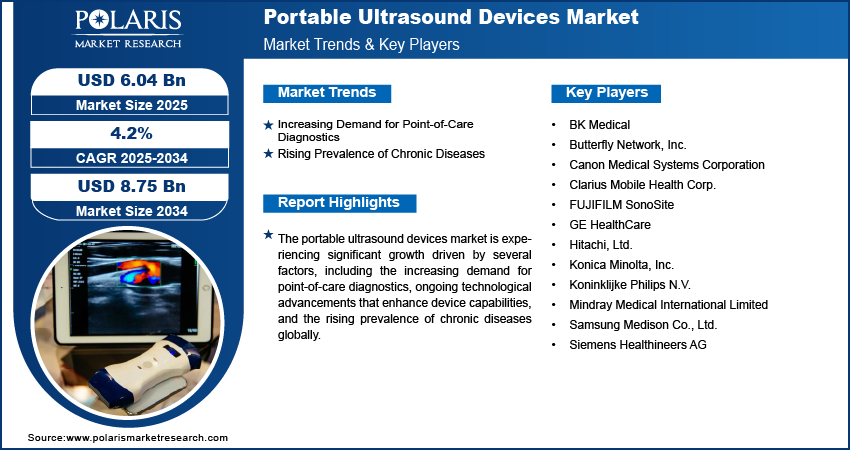

The global portable ultrasound devices market, valued at USD 5.81 billion in 2024, is projected to grow at a compound annual growth rate (CAGR) of 4.2% from 2025 to 2034, driven by the increasing demand for point-of-care diagnostics, rising healthcare accessibility needs, and advancements in miniaturization and imaging technology. This growth is not evenly distributed across geographies; rather, it is shaped by distinct regional manufacturing trends, regulatory frameworks, and evolving cross-border supply chain dynamics. North America, Europe, and Asia Pacific are emerging as pivotal markets, each navigating unique challenges and opportunities in the adoption and deployment of portable ultrasound systems.

In North America, particularly the United States, the market is the most mature, supported by a robust healthcare infrastructure, high physician adoption rates, and favorable reimbursement policies for diagnostic imaging. The U.S. Food and Drug Administration (FDA) maintains a well-established regulatory pathway for 510(k) clearance of portable ultrasound devices, enabling rapid commercialization of new entrants. Regional manufacturing trends show a shift toward domestic production of critical components, particularly in response to supply chain disruptions during the pandemic. Companies are increasingly investing in localized assembly and quality control to ensure compliance and reduce lead times. Market penetration strategies in the U.S. emphasize integration with electronic health records (EHRs), cloud-based image storage, and AI-powered interpretation tools, enhancing clinical utility and workflow efficiency in emergency departments, intensive care units, and outpatient clinics.

Europe presents a more fragmented but highly regulated landscape, with the European Union’s Medical Device Regulation (MDR) imposing stringent conformity assessment requirements. Countries such as Germany, France, and the United Kingdom lead in clinical adoption, particularly in anesthesia, critical care, and musculoskeletal applications. However, cross-border supply chains face challenges due to varying national reimbursement policies and procurement models. The EU’s emphasis on health technology assessment (HTA) requires manufacturers to demonstrate clinical and economic value, influencing pricing and market access strategies. Despite these hurdles, European firms are investing in regional manufacturing trends that emphasize energy efficiency, recyclable materials, and interoperability with existing hospital IT systems. Market penetration strategies often involve public-private partnerships, training programs for clinicians, and participation in national telemedicine initiatives to expand access in rural and underserved areas.

Read More @ https://www.polarismarketresearch.com/industry-analysis/portable-ultrasound-devices-market

Asia Pacific is witnessing accelerated growth, particularly in China, India, and Japan, where aging populations, rising chronic disease prevalence, and government-led healthcare modernization are driving demand. China’s “Healthy China 2030” initiative has prioritized medical device self-sufficiency, creating opportunities for domestic manufacturers to compete with multinational players. The country’s regional manufacturing trends are characterized by vertical integration, with firms producing transducers, processors, and software in-house to reduce costs and improve scalability. India is expanding its diagnostic infrastructure under the Ayushman Bharat scheme, creating demand for affordable, rugged portable ultrasound devices suitable for primary health centers. Market penetration strategies in the region often involve tiered pricing, mobile-first platforms, and collaborations with NGOs and government agencies to reach remote populations.

Market drivers include the growing burden of cardiovascular and abdominal diseases, increasing use of ultrasound in emergency medicine, and the shift toward decentralized care models. However, restraints such as high device costs, limited reimbursement in low- and middle-income countries, and shortage of trained sonographers limit widespread adoption. Opportunities lie in AI-driven image interpretation, integration with wearable sensors, and expansion into veterinary and home healthcare applications. Trends such as handheld device proliferation, real-time remote guidance, and blockchain-enabled image security are redefining the value proposition of portable ultrasound across diverse clinical settings.

The competitive landscape is dominated by a select group of global players with strong R&D capabilities, regulatory expertise, and extensive distribution networks.

The global portable ultrasound devices market, valued at USD 5.81 billion in 2024, is projected to grow at a compound annual growth rate (CAGR) of 4.2% from 2025 to 2034, driven by the increasing demand for point-of-care diagnostics, rising healthcare accessibility needs, and advancements in miniaturization and imaging technology. This growth is not evenly distributed across geographies; rather, it is shaped by distinct regional manufacturing trends, regulatory frameworks, and evolving cross-border supply chain dynamics. North America, Europe, and Asia Pacific are emerging as pivotal markets, each navigating unique challenges and opportunities in the adoption and deployment of portable ultrasound systems. In North America, particularly the United States, the market is the most mature, supported by a robust healthcare infrastructure, high physician adoption rates, and favorable reimbursement policies for diagnostic imaging. The U.S. Food and Drug Administration (FDA) maintains a well-established regulatory pathway for 510(k) clearance of portable ultrasound devices, enabling rapid commercialization of new entrants. Regional manufacturing trends show a shift toward domestic production of critical components, particularly in response to supply chain disruptions during the pandemic. Companies are increasingly investing in localized assembly and quality control to ensure compliance and reduce lead times. Market penetration strategies in the U.S. emphasize integration with electronic health records (EHRs), cloud-based image storage, and AI-powered interpretation tools, enhancing clinical utility and workflow efficiency in emergency departments, intensive care units, and outpatient clinics. Europe presents a more fragmented but highly regulated landscape, with the European Union’s Medical Device Regulation (MDR) imposing stringent conformity assessment requirements. Countries such as Germany, France, and the United Kingdom lead in clinical adoption, particularly in anesthesia, critical care, and musculoskeletal applications. However, cross-border supply chains face challenges due to varying national reimbursement policies and procurement models. The EU’s emphasis on health technology assessment (HTA) requires manufacturers to demonstrate clinical and economic value, influencing pricing and market access strategies. Despite these hurdles, European firms are investing in regional manufacturing trends that emphasize energy efficiency, recyclable materials, and interoperability with existing hospital IT systems. Market penetration strategies often involve public-private partnerships, training programs for clinicians, and participation in national telemedicine initiatives to expand access in rural and underserved areas. Read More @ https://www.polarismarketresearch.com/industry-analysis/portable-ultrasound-devices-market Asia Pacific is witnessing accelerated growth, particularly in China, India, and Japan, where aging populations, rising chronic disease prevalence, and government-led healthcare modernization are driving demand. China’s “Healthy China 2030” initiative has prioritized medical device self-sufficiency, creating opportunities for domestic manufacturers to compete with multinational players. The country’s regional manufacturing trends are characterized by vertical integration, with firms producing transducers, processors, and software in-house to reduce costs and improve scalability. India is expanding its diagnostic infrastructure under the Ayushman Bharat scheme, creating demand for affordable, rugged portable ultrasound devices suitable for primary health centers. Market penetration strategies in the region often involve tiered pricing, mobile-first platforms, and collaborations with NGOs and government agencies to reach remote populations. Market drivers include the growing burden of cardiovascular and abdominal diseases, increasing use of ultrasound in emergency medicine, and the shift toward decentralized care models. However, restraints such as high device costs, limited reimbursement in low- and middle-income countries, and shortage of trained sonographers limit widespread adoption. Opportunities lie in AI-driven image interpretation, integration with wearable sensors, and expansion into veterinary and home healthcare applications. Trends such as handheld device proliferation, real-time remote guidance, and blockchain-enabled image security are redefining the value proposition of portable ultrasound across diverse clinical settings. The competitive landscape is dominated by a select group of global players with strong R&D capabilities, regulatory expertise, and extensive distribution networks.0 Σχόλια ·0 Μοιράστηκε ·125 Views ·0 Προεπισκόπηση -

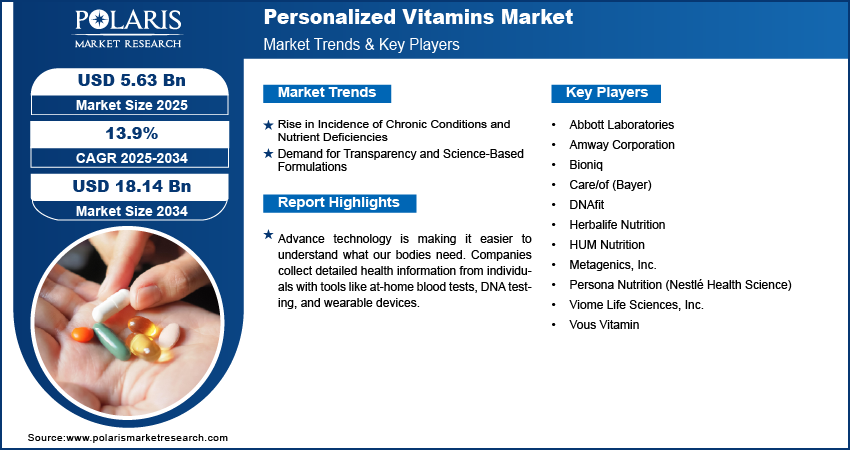

The global personalized vitamins market, valued at USD 4.96 billion in 2024, is projected to grow at a CAGR of 13.9% from 2025 to 2034, with national policy impact, R&D leadership, and strategic positioning shaping the competitive hierarchy among leading nations and corporations. The United States, Germany, China, and the United Kingdom are at the forefront of this transformation, each leveraging unique advantages in local manufacturing bases, innovation hubs, and regulatory frameworks to secure market leadership.

The United States remains the dominant force in personalized vitamins, accounting for over 40% of global market revenue. The country’s national policy impact is evident in the FDA’s flexible regulatory approach to dietary supplements, which enables rapid innovation and DTC commercialization. Federal funding through the National Institutes of Health (NIH) supports R&D leadership in nutrigenomics and microbiome science, with institutions like Stanford and MIT collaborating with startups on clinical validation studies. U.S.-based companies such as Ritual, Care/of, and InsideTracker have achieved market share concentration by combining AI-driven personalization, transparent sourcing, and subscription-based models. Their strategic positioning includes vertical integration, in-house formulation labs, and partnerships with wearable tech firms to enhance data inputs.

Germany leads in Europe due to its strong tradition in pharmaceutical-grade nutraceuticals and high consumer trust in evidence-based health products. The country’s national policy impact includes strict EFSA-compliant health claim regulations, which favor companies with robust clinical data. German firms such as DNAFit and Nutrino (acquired by One Drop) are investing in R&D leadership through collaborations with university hospitals and diagnostic labs. Local manufacturing bases emphasize GMP compliance, organic sourcing, and sustainability, reinforcing consumer confidence. Germany also serves as a logistics and regulatory hub for cross-border supply chains into other EU markets.

Read More @ https://www.polarismarketresearch.com/industry-analysis/personalized-vitamins-market

China is rapidly expanding its presence in the personalized nutrition space, driven by government-backed initiatives under “Healthy China 2030” and increasing investment in biotech innovation. While regulatory restrictions on genetic data limit full-scale personalization, Chinese firms are leveraging AI and traditional medicine databases to develop algorithm-driven vitamin regimens. Local manufacturing bases in Shenzhen and Shanghai are integrating smart factories with e-commerce platforms, enabling rapid customization and delivery. Strategic partnerships with global players like Nestlé Health Science are accelerating technology transfer and market access.

Corporate strategies among top players reflect a focus on mergers, digital integration, and tech advantages. Thorne Research’s acquisition of Vitagene strengthened its data analytics capabilities, while Nestlé’s investment in Persona by Nature Made enhanced its DTC footprint. These moves reflect a broader trend of market share concentration, where scale, scientific validation, and digital engagement determine competitive success.

The global personalized vitamins market, valued at USD 4.96 billion in 2024, is projected to grow at a CAGR of 13.9% from 2025 to 2034, with national policy impact, R&D leadership, and strategic positioning shaping the competitive hierarchy among leading nations and corporations. The United States, Germany, China, and the United Kingdom are at the forefront of this transformation, each leveraging unique advantages in local manufacturing bases, innovation hubs, and regulatory frameworks to secure market leadership. The United States remains the dominant force in personalized vitamins, accounting for over 40% of global market revenue. The country’s national policy impact is evident in the FDA’s flexible regulatory approach to dietary supplements, which enables rapid innovation and DTC commercialization. Federal funding through the National Institutes of Health (NIH) supports R&D leadership in nutrigenomics and microbiome science, with institutions like Stanford and MIT collaborating with startups on clinical validation studies. U.S.-based companies such as Ritual, Care/of, and InsideTracker have achieved market share concentration by combining AI-driven personalization, transparent sourcing, and subscription-based models. Their strategic positioning includes vertical integration, in-house formulation labs, and partnerships with wearable tech firms to enhance data inputs. Germany leads in Europe due to its strong tradition in pharmaceutical-grade nutraceuticals and high consumer trust in evidence-based health products. The country’s national policy impact includes strict EFSA-compliant health claim regulations, which favor companies with robust clinical data. German firms such as DNAFit and Nutrino (acquired by One Drop) are investing in R&D leadership through collaborations with university hospitals and diagnostic labs. Local manufacturing bases emphasize GMP compliance, organic sourcing, and sustainability, reinforcing consumer confidence. Germany also serves as a logistics and regulatory hub for cross-border supply chains into other EU markets. Read More @ https://www.polarismarketresearch.com/industry-analysis/personalized-vitamins-market China is rapidly expanding its presence in the personalized nutrition space, driven by government-backed initiatives under “Healthy China 2030” and increasing investment in biotech innovation. While regulatory restrictions on genetic data limit full-scale personalization, Chinese firms are leveraging AI and traditional medicine databases to develop algorithm-driven vitamin regimens. Local manufacturing bases in Shenzhen and Shanghai are integrating smart factories with e-commerce platforms, enabling rapid customization and delivery. Strategic partnerships with global players like Nestlé Health Science are accelerating technology transfer and market access. Corporate strategies among top players reflect a focus on mergers, digital integration, and tech advantages. Thorne Research’s acquisition of Vitagene strengthened its data analytics capabilities, while Nestlé’s investment in Persona by Nature Made enhanced its DTC footprint. These moves reflect a broader trend of market share concentration, where scale, scientific validation, and digital engagement determine competitive success.0 Σχόλια ·0 Μοιράστηκε ·127 Views ·0 Προεπισκόπηση -

The U.S. recycled PET (rPET) flakes market, valued at USD 2.04 billion in 2024, is expected to grow at a CAGR of 8.2% from 2025 to 2034, with growth increasingly driven by segment-specific dynamics in product type, end-user industry, and application. As the circular economy gains momentum, the market is shifting from a commoditized recycling model to one defined by product differentiation, application-specific growth, and value chain optimization. The rPET flakes market is segmented primarily by purity grade—non-food-grade, food-grade, and specialty-grade—each serving distinct industrial applications with varying regulatory, technical, and pricing requirements.

Non-food-grade rPET flakes represent the largest volume segment, primarily used in fiber production for textiles, carpets, and non-woven materials. This segment benefits from consistent demand in the automotive, construction, and apparel industries, where rPET is used in insulation, seat fabrics, and geotextiles. However, segment-wise performance is constrained by competition from virgin polyester and fluctuating fashion industry demand. To enhance competitiveness, U.S. recyclers are focusing on value chain optimization, including co-location of recycling plants with fiber spinning mills to reduce logistics costs and improve supply reliability. Innovations in dyeability, UV resistance, and fiber strength are enabling rPET to replace virgin materials in high-performance applications, particularly in technical textiles.

Food-grade rPET flakes represent the highest-value segment, requiring advanced decontamination, washing, and solid-state polymerization (SSP) to meet FDA and NSF International standards. Demand is being driven by major beverage companies aiming to meet self-imposed or state-mandated recycled content targets—some committing to 50% rPET in bottles by 2030. This application-specific growth is accelerating investment in superclean recycling lines capable of achieving intrinsic viscosity (IV) levels above 0.80 dL/g, essential for bottle-to-bottle recycling. The premium pricing of food-grade flakes—often 20–30% higher than non-food-grade—provides strong incentives for processors to upgrade their facilities. Companies like Indorama and M&G USA are expanding food-grade capacity to capture this high-margin segment.

Read More @ https://www.polarismarketresearch.com/industry-analysis/us-recycled-pet-flakes-market

Specialty-grade rPET, used in engineering plastics, thermoformed sheets, and strapping, is an emerging segment with high growth potential. These applications require consistent melt flow index (MFI), thermal stability, and color clarity, driving demand for highly purified flakes. U.S. firms are leveraging product differentiation through proprietary sorting algorithms and additive technologies that enhance mechanical properties. This segment is particularly attractive for export to high-margin markets in Europe and Canada, where sustainability regulations are stringent.

Market drivers include regulatory pressure, corporate ESG goals, and rising landfill costs. However, restraints such as inconsistent feedstock quality, high capital expenditure for food-grade lines, and competition from mechanical recycling in Asia limit scalability. Opportunities exist in chemical recycling, which can process mixed or colored PET waste. Trends such as digital traceability, AI-driven sorting, and blockchain-enabled certification are improving transparency and efficiency.

The U.S. recycled PET (rPET) flakes market, valued at USD 2.04 billion in 2024, is expected to grow at a CAGR of 8.2% from 2025 to 2034, with growth increasingly driven by segment-specific dynamics in product type, end-user industry, and application. As the circular economy gains momentum, the market is shifting from a commoditized recycling model to one defined by product differentiation, application-specific growth, and value chain optimization. The rPET flakes market is segmented primarily by purity grade—non-food-grade, food-grade, and specialty-grade—each serving distinct industrial applications with varying regulatory, technical, and pricing requirements. Non-food-grade rPET flakes represent the largest volume segment, primarily used in fiber production for textiles, carpets, and non-woven materials. This segment benefits from consistent demand in the automotive, construction, and apparel industries, where rPET is used in insulation, seat fabrics, and geotextiles. However, segment-wise performance is constrained by competition from virgin polyester and fluctuating fashion industry demand. To enhance competitiveness, U.S. recyclers are focusing on value chain optimization, including co-location of recycling plants with fiber spinning mills to reduce logistics costs and improve supply reliability. Innovations in dyeability, UV resistance, and fiber strength are enabling rPET to replace virgin materials in high-performance applications, particularly in technical textiles. Food-grade rPET flakes represent the highest-value segment, requiring advanced decontamination, washing, and solid-state polymerization (SSP) to meet FDA and NSF International standards. Demand is being driven by major beverage companies aiming to meet self-imposed or state-mandated recycled content targets—some committing to 50% rPET in bottles by 2030. This application-specific growth is accelerating investment in superclean recycling lines capable of achieving intrinsic viscosity (IV) levels above 0.80 dL/g, essential for bottle-to-bottle recycling. The premium pricing of food-grade flakes—often 20–30% higher than non-food-grade—provides strong incentives for processors to upgrade their facilities. Companies like Indorama and M&G USA are expanding food-grade capacity to capture this high-margin segment. Read More @ https://www.polarismarketresearch.com/industry-analysis/us-recycled-pet-flakes-market Specialty-grade rPET, used in engineering plastics, thermoformed sheets, and strapping, is an emerging segment with high growth potential. These applications require consistent melt flow index (MFI), thermal stability, and color clarity, driving demand for highly purified flakes. U.S. firms are leveraging product differentiation through proprietary sorting algorithms and additive technologies that enhance mechanical properties. This segment is particularly attractive for export to high-margin markets in Europe and Canada, where sustainability regulations are stringent. Market drivers include regulatory pressure, corporate ESG goals, and rising landfill costs. However, restraints such as inconsistent feedstock quality, high capital expenditure for food-grade lines, and competition from mechanical recycling in Asia limit scalability. Opportunities exist in chemical recycling, which can process mixed or colored PET waste. Trends such as digital traceability, AI-driven sorting, and blockchain-enabled certification are improving transparency and efficiency.0 Σχόλια ·0 Μοιράστηκε ·93 Views ·0 Προεπισκόπηση -

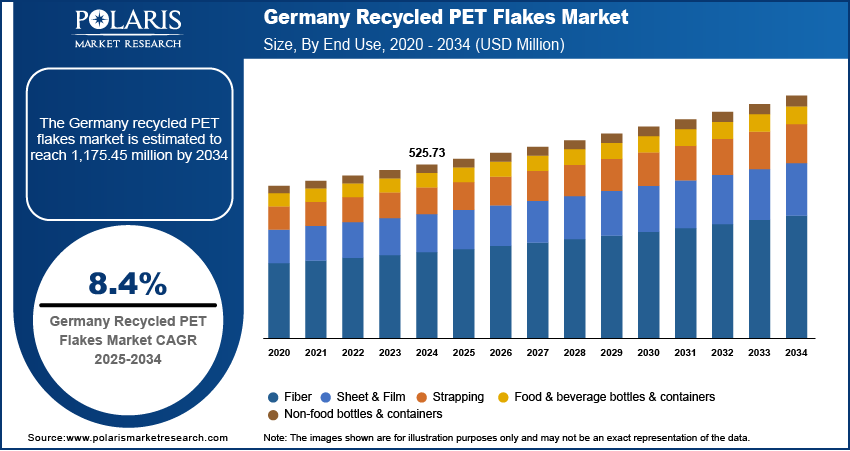

The Germany recycled PET (rPET) flakes market, valued at USD 525.73 million in 2024, is projected to grow at a compound annual growth rate (CAGR) of 8.4% from 2025 to 2034, driven by stringent environmental regulations, robust circular economy policies, and rising corporate sustainability mandates. As Europe’s largest economy and a leader in environmental governance, Germany plays a pivotal role in shaping the regional and global rPET landscape. The country’s influence extends beyond its borders, impacting regional manufacturing trends, cross-border supply chains, and market penetration strategies across Europe, North America, and Asia Pacific. Germany’s advanced waste management infrastructure and high consumer awareness of plastic pollution have positioned it as a benchmark for recycling efficiency and regulatory innovation.

Within Europe, Germany operates under the Extended Producer Responsibility (EPR) framework established by the German Packaging Act (Verpackungsgesetz), which mandates that producers finance the collection, sorting, and recycling of packaging waste. This national policy impact ensures a stable supply of post-consumer PET bottles, with a recycling rate exceeding 97% for deposit-bearing containers—among the highest in the world. The dual system managed by Der Grüne Punkt (DSD) and other compliance schemes ensures efficient collection and sorting, providing high-purity feedstock for rPET flake producers. Regional manufacturing trends in Germany emphasize automation, traceability, and integration with downstream industries such as beverage bottling and textile manufacturing. German recyclers are increasingly investing in near-infrared (NIR) sorting, advanced washing lines, and solid-state polymerization (SSP) to meet food-grade specifications, aligning with European Food Safety Authority (EFSA) standards.

Cross-border supply chains are a critical component of Germany’s rPET ecosystem. While the country is largely self-sufficient in PET collection, it imports secondary raw materials such as baled PET from neighboring countries including Poland, Austria, and the Netherlands to optimize processing capacity. Conversely, Germany exports high-quality rPET flakes to countries with insufficient domestic recycling infrastructure, including Italy, Spain, and parts of Eastern Europe. These flows are shaped by the European Union’s Circular Economy Action Plan and the Packaging and Packaging Waste Regulation (PPWR), which will require PET bottles to contain 30% recycled content by 2030. This regulatory tailwind is driving market penetration strategies focused on long-term supply agreements with multinational brand owners such as Coca-Cola, Nestlé, and Unilever, all of which have committed to increasing rPET usage in their packaging.

Read More @ https://www.polarismarketresearch.com/industry-analysis/germany-recycled-pet-flakes-market

In North America, the rPET market is expanding due to state-level container deposit laws and corporate ESG goals, but faces challenges related to fragmented collection systems and lower recycling rates. U.S. firms are increasingly looking to German recycling facilities for technology transfer and process optimization, particularly in food-grade recycling and decontamination. Meanwhile, in Asia Pacific, countries like China and Japan are advancing their domestic recycling capabilities, but still rely on European expertise for high-purity flake production. Germany’s role as a technology exporter and process innovator enhances its strategic positioning in global supply chains, particularly in licensing advanced sorting and washing systems to emerging markets.

Market drivers include regulatory mandates, brand owner sustainability commitments, and rising landfill and incineration costs. However, restraints such as contamination in mixed waste streams, fluctuating virgin PET prices, and energy-intensive recycling processes limit profitability. Opportunities lie in scaling chemical recycling technologies—such as glycolysis and methanolysis—enabling the processing of mixed or colored PET waste unsuitable for mechanical recycling. Trends such as digital watermarking for improved sorting accuracy, blockchain-based material tracing, and industrial symbiosis—where waste heat and byproducts are reused across facilities—are gaining traction, particularly in industrial clusters around Frankfurt, Hamburg, and Leipzig.

The competitive landscape is dominated by integrated waste management firms, specialized recyclers, and petrochemical companies with downstream processing capabilities.

The Germany recycled PET (rPET) flakes market, valued at USD 525.73 million in 2024, is projected to grow at a compound annual growth rate (CAGR) of 8.4% from 2025 to 2034, driven by stringent environmental regulations, robust circular economy policies, and rising corporate sustainability mandates. As Europe’s largest economy and a leader in environmental governance, Germany plays a pivotal role in shaping the regional and global rPET landscape. The country’s influence extends beyond its borders, impacting regional manufacturing trends, cross-border supply chains, and market penetration strategies across Europe, North America, and Asia Pacific. Germany’s advanced waste management infrastructure and high consumer awareness of plastic pollution have positioned it as a benchmark for recycling efficiency and regulatory innovation. Within Europe, Germany operates under the Extended Producer Responsibility (EPR) framework established by the German Packaging Act (Verpackungsgesetz), which mandates that producers finance the collection, sorting, and recycling of packaging waste. This national policy impact ensures a stable supply of post-consumer PET bottles, with a recycling rate exceeding 97% for deposit-bearing containers—among the highest in the world. The dual system managed by Der Grüne Punkt (DSD) and other compliance schemes ensures efficient collection and sorting, providing high-purity feedstock for rPET flake producers. Regional manufacturing trends in Germany emphasize automation, traceability, and integration with downstream industries such as beverage bottling and textile manufacturing. German recyclers are increasingly investing in near-infrared (NIR) sorting, advanced washing lines, and solid-state polymerization (SSP) to meet food-grade specifications, aligning with European Food Safety Authority (EFSA) standards. Cross-border supply chains are a critical component of Germany’s rPET ecosystem. While the country is largely self-sufficient in PET collection, it imports secondary raw materials such as baled PET from neighboring countries including Poland, Austria, and the Netherlands to optimize processing capacity. Conversely, Germany exports high-quality rPET flakes to countries with insufficient domestic recycling infrastructure, including Italy, Spain, and parts of Eastern Europe. These flows are shaped by the European Union’s Circular Economy Action Plan and the Packaging and Packaging Waste Regulation (PPWR), which will require PET bottles to contain 30% recycled content by 2030. This regulatory tailwind is driving market penetration strategies focused on long-term supply agreements with multinational brand owners such as Coca-Cola, Nestlé, and Unilever, all of which have committed to increasing rPET usage in their packaging. Read More @ https://www.polarismarketresearch.com/industry-analysis/germany-recycled-pet-flakes-market In North America, the rPET market is expanding due to state-level container deposit laws and corporate ESG goals, but faces challenges related to fragmented collection systems and lower recycling rates. U.S. firms are increasingly looking to German recycling facilities for technology transfer and process optimization, particularly in food-grade recycling and decontamination. Meanwhile, in Asia Pacific, countries like China and Japan are advancing their domestic recycling capabilities, but still rely on European expertise for high-purity flake production. Germany’s role as a technology exporter and process innovator enhances its strategic positioning in global supply chains, particularly in licensing advanced sorting and washing systems to emerging markets. Market drivers include regulatory mandates, brand owner sustainability commitments, and rising landfill and incineration costs. However, restraints such as contamination in mixed waste streams, fluctuating virgin PET prices, and energy-intensive recycling processes limit profitability. Opportunities lie in scaling chemical recycling technologies—such as glycolysis and methanolysis—enabling the processing of mixed or colored PET waste unsuitable for mechanical recycling. Trends such as digital watermarking for improved sorting accuracy, blockchain-based material tracing, and industrial symbiosis—where waste heat and byproducts are reused across facilities—are gaining traction, particularly in industrial clusters around Frankfurt, Hamburg, and Leipzig. The competitive landscape is dominated by integrated waste management firms, specialized recyclers, and petrochemical companies with downstream processing capabilities.0 Σχόλια ·0 Μοιράστηκε ·95 Views ·0 Προεπισκόπηση -

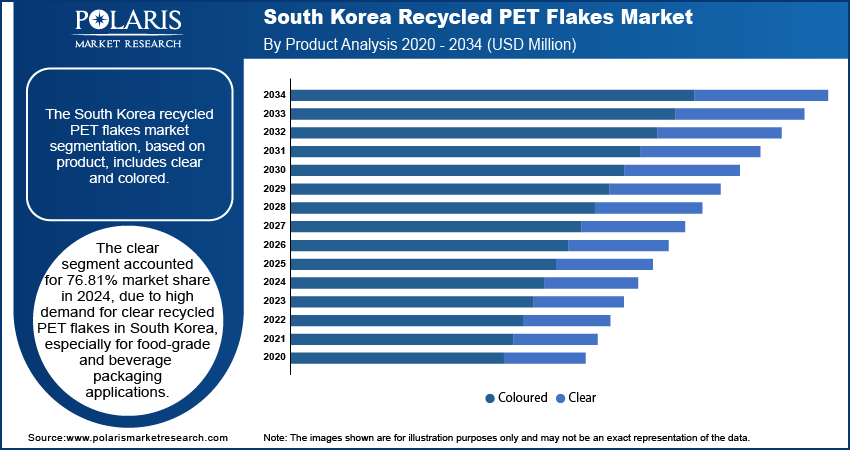

The South Korea recycled PET (rPET) flakes market, valued at USD 439.59 million in 2024, is expected to grow at a CAGR of 8.1% from 2025 to 2034, with growth increasingly driven by segment-specific dynamics in end-use applications, product grades, and material specifications. As the circular economy gains momentum, the market is shifting from a commodity-based model to one defined by product differentiation, application-specific growth, and value chain optimization. The rPET flakes market is segmented primarily by purity grade—non-food-grade, food-grade, and specialty-grade—each serving distinct industrial applications with varying pricing, regulatory, and performance requirements.

Non-food-grade rPET flakes, typically derived from mixed or contaminated post-consumer bottles, are used in fiber production for textiles, carpets, and non-woven fabrics. This segment remains the largest by volume, accounting for over 60% of domestic rPET utilization. However, segment-wise performance is under pressure due to competition from virgin polyester and fluctuating fashion industry demand. Manufacturers are responding with value chain optimization, such as co-locating recycling plants with spinning mills to reduce logistics costs and improve supply reliability. Innovations in dyeability and fiber strength are also enhancing the competitiveness of rPET in technical textiles, particularly in automotive interiors and geotextiles.

Food-grade rPET flakes represent the highest-value segment, requiring advanced washing, decontamination, and SSP processes to meet Korea Food and Drug Administration (KFDA) and FDA standards. Demand for food-grade rPET is being driven by major beverage companies, including PepsiCo Korea and Lotte Chilsung, which have committed to using 50% or more recycled content in their bottles by 2030. This application-specific growth is accelerating investment in superclean recycling lines capable of achieving intrinsic viscosity (IV) levels above 0.80 dL/g, essential for bottle-to-bottle recycling. The premium pricing of food-grade flakes—often 20–30% higher than non-food-grade—provides strong incentives for processors to upgrade their facilities.

Read More @ https://www.polarismarketresearch.com/industry-analysis/south-korea-recycled-pet-flakes-market

Specialty-grade rPET, used in engineering plastics, films, and strapping, is an emerging segment with high growth potential. These applications require consistent melt flow index (MFI), thermal stability, and color clarity, driving demand for highly purified flakes. Korean firms are leveraging product differentiation through proprietary sorting algorithms and additive technologies that enhance UV resistance and mechanical properties. This segment is particularly attractive for export to high-margin markets in Europe and Japan, where sustainability regulations are stringent and brand owners prioritize traceability.

Market drivers include regulatory pressure, corporate ESG goals, and rising landfill costs. However, restraints such as inconsistent feedstock quality, high capital expenditure for food-grade lines, and competition from mechanical recycling in China limit scalability. Opportunities exist in chemical recycling via glycolysis and methanolysis, which can process mixed or colored PET waste that is unsuitable for mechanical recycling. Trends such as digital traceability, blockchain-enabled certification, and AI-driven sorting are improving transparency and efficiency across the value chain.

The competitive landscape is characterized by a mix of petrochemical giants and specialized recyclers investing in technology and compliance to capture high-margin segments.

• Lotte Chemical Corporation

• SK Geo Centric Co., Ltd.

• Korea Pulp Corporation

• Dongyang Corporation

• Hanwha Solutions

• Woongjin Co., Ltd.

• Sejong Recycling Co., Ltd.

• Korea Resources Recycling Corporation

• Daekyung Environment Co., Ltd.

• Siam Cement Group (SCG) Korea

More Trending Latest Reports By Polaris Market Research:

Cloud Kitchen Market

Asset Tokenization Market

Dental Obturators Market

Ammonia Market

Remote Weapon Station Market

Ben Oil Market

U.S. Postal Automation Systems Market

AI in Cybersecurity Market

Air Quality Monitoring Systems Market

The South Korea recycled PET (rPET) flakes market, valued at USD 439.59 million in 2024, is expected to grow at a CAGR of 8.1% from 2025 to 2034, with growth increasingly driven by segment-specific dynamics in end-use applications, product grades, and material specifications. As the circular economy gains momentum, the market is shifting from a commodity-based model to one defined by product differentiation, application-specific growth, and value chain optimization. The rPET flakes market is segmented primarily by purity grade—non-food-grade, food-grade, and specialty-grade—each serving distinct industrial applications with varying pricing, regulatory, and performance requirements. Non-food-grade rPET flakes, typically derived from mixed or contaminated post-consumer bottles, are used in fiber production for textiles, carpets, and non-woven fabrics. This segment remains the largest by volume, accounting for over 60% of domestic rPET utilization. However, segment-wise performance is under pressure due to competition from virgin polyester and fluctuating fashion industry demand. Manufacturers are responding with value chain optimization, such as co-locating recycling plants with spinning mills to reduce logistics costs and improve supply reliability. Innovations in dyeability and fiber strength are also enhancing the competitiveness of rPET in technical textiles, particularly in automotive interiors and geotextiles. Food-grade rPET flakes represent the highest-value segment, requiring advanced washing, decontamination, and SSP processes to meet Korea Food and Drug Administration (KFDA) and FDA standards. Demand for food-grade rPET is being driven by major beverage companies, including PepsiCo Korea and Lotte Chilsung, which have committed to using 50% or more recycled content in their bottles by 2030. This application-specific growth is accelerating investment in superclean recycling lines capable of achieving intrinsic viscosity (IV) levels above 0.80 dL/g, essential for bottle-to-bottle recycling. The premium pricing of food-grade flakes—often 20–30% higher than non-food-grade—provides strong incentives for processors to upgrade their facilities. Read More @ https://www.polarismarketresearch.com/industry-analysis/south-korea-recycled-pet-flakes-market Specialty-grade rPET, used in engineering plastics, films, and strapping, is an emerging segment with high growth potential. These applications require consistent melt flow index (MFI), thermal stability, and color clarity, driving demand for highly purified flakes. Korean firms are leveraging product differentiation through proprietary sorting algorithms and additive technologies that enhance UV resistance and mechanical properties. This segment is particularly attractive for export to high-margin markets in Europe and Japan, where sustainability regulations are stringent and brand owners prioritize traceability. Market drivers include regulatory pressure, corporate ESG goals, and rising landfill costs. However, restraints such as inconsistent feedstock quality, high capital expenditure for food-grade lines, and competition from mechanical recycling in China limit scalability. Opportunities exist in chemical recycling via glycolysis and methanolysis, which can process mixed or colored PET waste that is unsuitable for mechanical recycling. Trends such as digital traceability, blockchain-enabled certification, and AI-driven sorting are improving transparency and efficiency across the value chain. The competitive landscape is characterized by a mix of petrochemical giants and specialized recyclers investing in technology and compliance to capture high-margin segments. • Lotte Chemical Corporation • SK Geo Centric Co., Ltd. • Korea Pulp Corporation • Dongyang Corporation • Hanwha Solutions • Woongjin Co., Ltd. • Sejong Recycling Co., Ltd. • Korea Resources Recycling Corporation • Daekyung Environment Co., Ltd. • Siam Cement Group (SCG) Korea More Trending Latest Reports By Polaris Market Research: Cloud Kitchen Market Asset Tokenization Market Dental Obturators Market Ammonia Market Remote Weapon Station Market Ben Oil Market U.S. Postal Automation Systems Market AI in Cybersecurity Market Air Quality Monitoring Systems Market0 Σχόλια ·0 Μοιράστηκε ·140 Views ·0 Προεπισκόπηση -

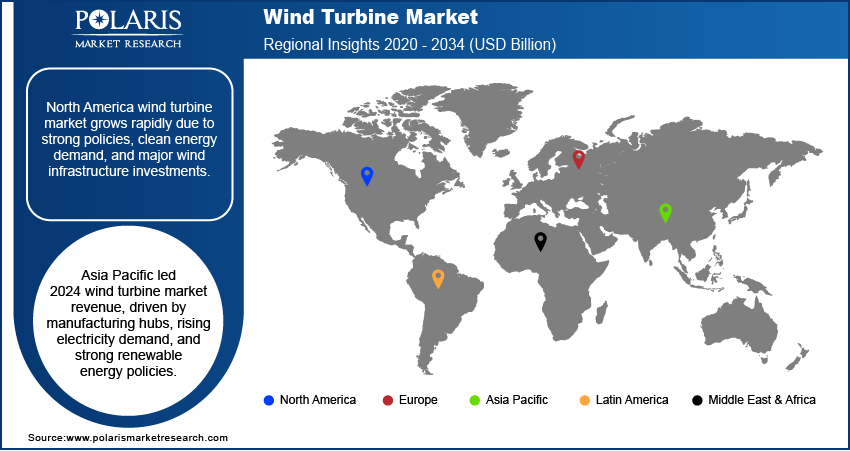

The global wind turbine market, valued at USD 143.69 billion in 2024, is projected to grow at a CAGR of 7.7% from 2025 to 2034, with national policy impact, R&D leadership, and strategic positioning determining the competitive hierarchy among leading nations and corporations. The United States, China, Germany, and Denmark are at the forefront of this transformation, each leveraging unique advantages in local manufacturing bases, innovation hubs, and trade policy frameworks to secure market leadership.

China remains the dominant force in wind turbine production and deployment, accounting for over 40% of global installed capacity. The country’s national policy impact is evident in its Five-Year Plans, which set binding renewable energy targets and provide subsidies for domestic manufacturers. Chinese firms such as Goldwind, Envision, and Mingyang have achieved economies of scale, enabling them to offer competitively priced turbines in both domestic and international markets. China’s local manufacturing base is highly integrated, with complete supply chains for towers, generators, and control systems, reducing reliance on foreign components. However, geopolitical tensions and trade barriers in Europe and North America are prompting Chinese OEMs to establish overseas assembly plants to circumvent tariffs and improve market access.

Read More @ https://www.polarismarketresearch.com/industry-analysis/wind-turbine-market

The United States is reasserting its position in the wind sector through the Inflation Reduction Act (IRA), which extends the Production Tax Credit (PTC) and Investment Tax Credit (ITC) through 2032. The IRA’s domestic content provisions offer bonus credits for turbines using U.S.-manufactured steel, blades, and nacelles, incentivizing reshoring of production. This national policy impact is driving corporate strategies, with GE Vernova expanding its blade and tower facilities in the Midwest. The U.S. also hosts key innovation hubs, such as the National Renewable Energy Laboratory (NREL), which leads in R&D leadership for next-generation turbine design, floating offshore platforms, and grid integration technologies.

Germany and Denmark exemplify R&D leadership and strategic positioning in offshore wind. Germany’s Energiewende policy has driven aggressive wind deployment, with Siemens Gamesa and Enercon at the core of its industrial strategy. The country’s Fraunhofer Institutes and offshore test centers support continuous innovation in turbine reliability and digital monitoring. Denmark, home to Vestas, has cultivated a world-class innovation ecosystem, with strong collaboration between industry, academia, and government. Danish wind firms benefit from early-mover advantage, deep technical expertise, and a global service network, contributing to high market share concentration.

Corporate strategies among top players are increasingly focused on mergers, expansions, and tech advantages. Vestas has prioritized blade recycling and digital service platforms, while Siemens Gamesa is investing in recyclable blade materials and offshore service vessels. GE Vernova’s acquisition of LM Wind Power strengthened its vertical integration, enhancing value chain optimization. These moves reflect a broader trend of strategic positioning, where scale, innovation, and sustainability define competitive success.

The global wind turbine market, valued at USD 143.69 billion in 2024, is projected to grow at a CAGR of 7.7% from 2025 to 2034, with national policy impact, R&D leadership, and strategic positioning determining the competitive hierarchy among leading nations and corporations. The United States, China, Germany, and Denmark are at the forefront of this transformation, each leveraging unique advantages in local manufacturing bases, innovation hubs, and trade policy frameworks to secure market leadership. China remains the dominant force in wind turbine production and deployment, accounting for over 40% of global installed capacity. The country’s national policy impact is evident in its Five-Year Plans, which set binding renewable energy targets and provide subsidies for domestic manufacturers. Chinese firms such as Goldwind, Envision, and Mingyang have achieved economies of scale, enabling them to offer competitively priced turbines in both domestic and international markets. China’s local manufacturing base is highly integrated, with complete supply chains for towers, generators, and control systems, reducing reliance on foreign components. However, geopolitical tensions and trade barriers in Europe and North America are prompting Chinese OEMs to establish overseas assembly plants to circumvent tariffs and improve market access. Read More @ https://www.polarismarketresearch.com/industry-analysis/wind-turbine-market The United States is reasserting its position in the wind sector through the Inflation Reduction Act (IRA), which extends the Production Tax Credit (PTC) and Investment Tax Credit (ITC) through 2032. The IRA’s domestic content provisions offer bonus credits for turbines using U.S.-manufactured steel, blades, and nacelles, incentivizing reshoring of production. This national policy impact is driving corporate strategies, with GE Vernova expanding its blade and tower facilities in the Midwest. The U.S. also hosts key innovation hubs, such as the National Renewable Energy Laboratory (NREL), which leads in R&D leadership for next-generation turbine design, floating offshore platforms, and grid integration technologies. Germany and Denmark exemplify R&D leadership and strategic positioning in offshore wind. Germany’s Energiewende policy has driven aggressive wind deployment, with Siemens Gamesa and Enercon at the core of its industrial strategy. The country’s Fraunhofer Institutes and offshore test centers support continuous innovation in turbine reliability and digital monitoring. Denmark, home to Vestas, has cultivated a world-class innovation ecosystem, with strong collaboration between industry, academia, and government. Danish wind firms benefit from early-mover advantage, deep technical expertise, and a global service network, contributing to high market share concentration. Corporate strategies among top players are increasingly focused on mergers, expansions, and tech advantages. Vestas has prioritized blade recycling and digital service platforms, while Siemens Gamesa is investing in recyclable blade materials and offshore service vessels. GE Vernova’s acquisition of LM Wind Power strengthened its vertical integration, enhancing value chain optimization. These moves reflect a broader trend of strategic positioning, where scale, innovation, and sustainability define competitive success.0 Σχόλια ·0 Μοιράστηκε ·127 Views ·0 Προεπισκόπηση -

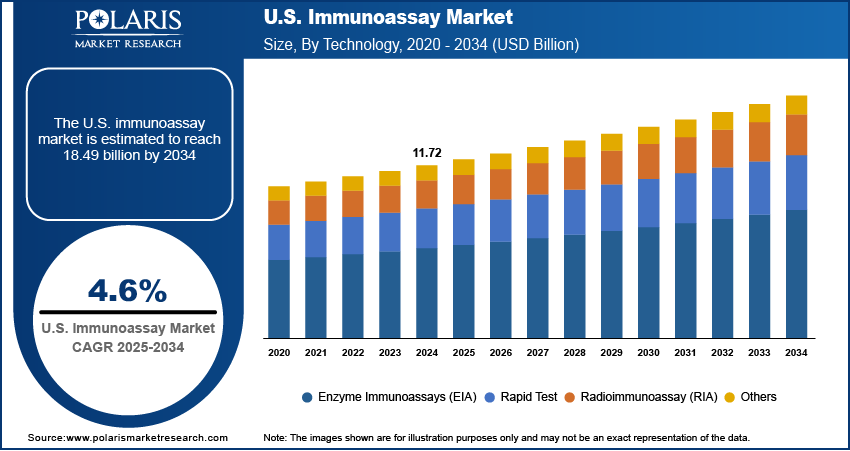

The U.S. immunoassay market, valued at USD 11.72 billion in 2024, is projected to grow at a CAGR of 4.6% from 2025 to 2034, with national policy impact, R&D leadership, and strategic positioning shaping the competitive dynamics across key geographies. While the United States remains the largest market, countries such as Germany, China, and Japan are playing increasingly influential roles through innovation hubs, local manufacturing bases, and supportive trade policies. These nations are not only major consumers but also critical contributors to global supply chains and technological advancement in immunoassay development.

The United States maintains its leadership through a combination of advanced healthcare infrastructure, strong intellectual property protection, and federal funding for biomedical research. National policy impact is evident in initiatives such as the National Institutes of Health (NIH) grants and the Biomedical Advanced Research and Development Authority (BARDA), which have accelerated the development of immunoassays for infectious diseases and biodefense. The FDA’s Breakthrough Devices Program has also expedited the approval of high-impact diagnostic platforms, reinforcing the U.S. as a hub for innovation. Major players such as Abbott and Thermo Fisher have leveraged this environment to launch next-generation immunoassay systems with enhanced sensitivity and automation.

Germany stands out in Europe for its engineering excellence and robust diagnostic industry. The country’s national policy impact includes funding for MedTech innovation through the Federal Ministry of Education and Research (BMBF), as well as strong collaboration between industry and academic institutions. German companies like Siemens Healthineers and Roche Diagnostics (with significant operations in Germany) are at the forefront of R&D leadership, particularly in high-precision immunoassay platforms and integrated lab solutions. Germany also serves as a key logistics node for cross-border supply chains, enabling efficient distribution across the EU.

Read More @ https://www.polarismarketresearch.com/industry-analysis/us-immunoassay-market

China is rapidly expanding its immunoassay capabilities, driven by government-backed initiatives to achieve self-reliance in critical medical technologies. The “Made in China 2025” and “14th Five-Year Plan” prioritize domestic production of diagnostic reagents and instruments, reducing reliance on foreign suppliers. Chinese firms such as Mindray and Autobio Diagnostics are investing heavily in R&D and forming strategic partnerships with global players to access advanced technologies. Local manufacturing bases are being expanded to meet growing domestic demand and to export to emerging markets in Asia, Africa, and Latin America.

Japan’s immunoassay market is characterized by high standards of quality and precision, supported by a strong tradition of engineering and biotechnology innovation. The Pharmaceuticals and Medical Devices Agency (PMDA) ensures rigorous validation of immunoassay products, fostering trust in clinical settings. Japanese companies like Fujirebio and Sysmex are known for their niche expertise in tumor markers and autoimmune testing, contributing to market share concentration in specialized segments.

Corporate strategies among top players are increasingly focused on mergers, expansions, and tech advantages. Abbott’s acquisition of St. Jude Medical and Thermo Fisher’s purchase of Qiagen have strengthened their diagnostic portfolios. Roche and Siemens are investing in AI-driven immunoassay interpretation and digital pathology integration, enhancing their strategic positioning. These moves reflect a broader trend of market share concentration, where scale, innovation, and global reach determine competitive success.The U.S. immunoassay market, valued at USD 11.72 billion in 2024, is projected to grow at a CAGR of 4.6% from 2025 to 2034, with national policy impact, R&D leadership, and strategic positioning shaping the competitive dynamics across key geographies. While the United States remains the largest market, countries such as Germany, China, and Japan are playing increasingly influential roles through innovation hubs, local manufacturing bases, and supportive trade policies. These nations are not only major consumers but also critical contributors to global supply chains and technological advancement in immunoassay development. The United States maintains its leadership through a combination of advanced healthcare infrastructure, strong intellectual property protection, and federal funding for biomedical research. National policy impact is evident in initiatives such as the National Institutes of Health (NIH) grants and the Biomedical Advanced Research and Development Authority (BARDA), which have accelerated the development of immunoassays for infectious diseases and biodefense. The FDA’s Breakthrough Devices Program has also expedited the approval of high-impact diagnostic platforms, reinforcing the U.S. as a hub for innovation. Major players such as Abbott and Thermo Fisher have leveraged this environment to launch next-generation immunoassay systems with enhanced sensitivity and automation. Germany stands out in Europe for its engineering excellence and robust diagnostic industry. The country’s national policy impact includes funding for MedTech innovation through the Federal Ministry of Education and Research (BMBF), as well as strong collaboration between industry and academic institutions. German companies like Siemens Healthineers and Roche Diagnostics (with significant operations in Germany) are at the forefront of R&D leadership, particularly in high-precision immunoassay platforms and integrated lab solutions. Germany also serves as a key logistics node for cross-border supply chains, enabling efficient distribution across the EU. Read More @ https://www.polarismarketresearch.com/industry-analysis/us-immunoassay-market China is rapidly expanding its immunoassay capabilities, driven by government-backed initiatives to achieve self-reliance in critical medical technologies. The “Made in China 2025” and “14th Five-Year Plan” prioritize domestic production of diagnostic reagents and instruments, reducing reliance on foreign suppliers. Chinese firms such as Mindray and Autobio Diagnostics are investing heavily in R&D and forming strategic partnerships with global players to access advanced technologies. Local manufacturing bases are being expanded to meet growing domestic demand and to export to emerging markets in Asia, Africa, and Latin America. Japan’s immunoassay market is characterized by high standards of quality and precision, supported by a strong tradition of engineering and biotechnology innovation. The Pharmaceuticals and Medical Devices Agency (PMDA) ensures rigorous validation of immunoassay products, fostering trust in clinical settings. Japanese companies like Fujirebio and Sysmex are known for their niche expertise in tumor markers and autoimmune testing, contributing to market share concentration in specialized segments. Corporate strategies among top players are increasingly focused on mergers, expansions, and tech advantages. Abbott’s acquisition of St. Jude Medical and Thermo Fisher’s purchase of Qiagen have strengthened their diagnostic portfolios. Roche and Siemens are investing in AI-driven immunoassay interpretation and digital pathology integration, enhancing their strategic positioning. These moves reflect a broader trend of market share concentration, where scale, innovation, and global reach determine competitive success.0 Σχόλια ·0 Μοιράστηκε ·129 Views ·0 Προεπισκόπηση -

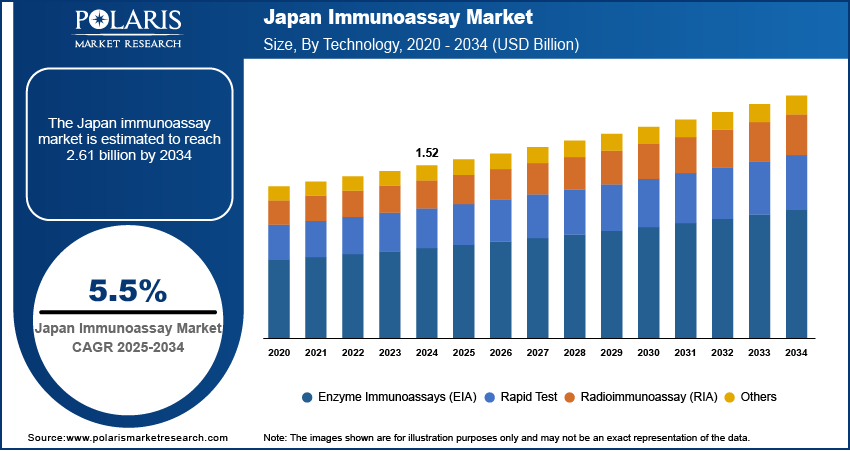

The Japan immunoassay market, valued at USD 1.52 billion in 2024 and projected to grow at a 5.5% CAGR through 2034, reflects the country’s strategic positioning as a global leader in diagnostic innovation, driven by strong national policy impact, R&D leadership, and deep integration into international healthcare ecosystems. Japan ranks among the top five global markets for immunoassays, alongside the U.S., Germany, China, and France, benefiting from a highly skilled workforce, advanced manufacturing capabilities, and government-backed initiatives that promote technological self-reliance. The Society 5.0 initiative, launched by the Cabinet Office, emphasizes the fusion of physical and digital technologies, directly influencing R&D investments in AI-powered diagnostics, microfluidic platforms, and tele-laboratory services. This national policy impact is reinforced by the Ministry of Economy, Trade and Industry (METI), which provides grants and tax incentives for companies developing next-generation in vitro diagnostics.

Japan’s local manufacturing bases in Kobe, Osaka, and Tsukuba are home to innovation hubs where firms like Sysmex, Fujirebio, and Roche Diagnostics K.K. conduct cutting-edge research in high-sensitivity assay development, biomarker discovery, and automated sample processing. These clusters benefit from close collaboration with academic institutions such as the University of Tokyo and Kyoto University, enabling rapid translation of scientific discoveries into commercial products. The country’s emphasis on precision engineering and quality control gives it a distinct tech advantage in producing complex, high-performance immunoassay platforms that are difficult to replicate in low-cost manufacturing regions. Market share concentration is evident in the dominance of Sysmex and Fujirebio, which together control over 45% of the domestic immunoassay market, leveraging economies of scale and extensive distribution networks.

Read More @ https://www.polarismarketresearch.com/industry-analysis/japan-immunoassay-market

Strategic positioning is further enhanced by corporate expansions and international partnerships. Fujirebio’s acquisition of Miraca Holdings’ diagnostics division strengthened its oncology portfolio and expanded its global footprint. Similarly, Sysmex has expanded into AI-driven hematology and immunoassay analytics through collaborations with cloud diagnostics firms, positioning itself at the forefront of digital pathology. These moves reflect a broader trend of market consolidation, where scale and technological differentiation determine long-term competitiveness. Trade policies within the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) also facilitate smoother export of immunoassay equipment to Canada, Australia, and Mexico, reducing tariffs and regulatory barriers.

Competitive Landscape:

• Sysmex Corporation

• Fujirebio Inc.

• Roche Diagnostics K.K.

• Abbott Japan Co., Ltd.

• Siemens Healthineers K.K.

• Beckman Coulter, Inc.

• Ortho Clinical Diagnostics

• Thermo Fisher Scientific K.K.

More Trending Latest Reports By Polaris Market Research:

Sorbitol Market

Formulation Development Outsourcing Market

Freight Wagon Market

Healthcare Supply Chain Management Market

Azimuth Thrusters Market

Cell Signaling Market

Europe Digestive Health Supplements Market

Prepreg Market

Tactical Communication Market

The Japan immunoassay market, valued at USD 1.52 billion in 2024 and projected to grow at a 5.5% CAGR through 2034, reflects the country’s strategic positioning as a global leader in diagnostic innovation, driven by strong national policy impact, R&D leadership, and deep integration into international healthcare ecosystems. Japan ranks among the top five global markets for immunoassays, alongside the U.S., Germany, China, and France, benefiting from a highly skilled workforce, advanced manufacturing capabilities, and government-backed initiatives that promote technological self-reliance. The Society 5.0 initiative, launched by the Cabinet Office, emphasizes the fusion of physical and digital technologies, directly influencing R&D investments in AI-powered diagnostics, microfluidic platforms, and tele-laboratory services. This national policy impact is reinforced by the Ministry of Economy, Trade and Industry (METI), which provides grants and tax incentives for companies developing next-generation in vitro diagnostics. Japan’s local manufacturing bases in Kobe, Osaka, and Tsukuba are home to innovation hubs where firms like Sysmex, Fujirebio, and Roche Diagnostics K.K. conduct cutting-edge research in high-sensitivity assay development, biomarker discovery, and automated sample processing. These clusters benefit from close collaboration with academic institutions such as the University of Tokyo and Kyoto University, enabling rapid translation of scientific discoveries into commercial products. The country’s emphasis on precision engineering and quality control gives it a distinct tech advantage in producing complex, high-performance immunoassay platforms that are difficult to replicate in low-cost manufacturing regions. Market share concentration is evident in the dominance of Sysmex and Fujirebio, which together control over 45% of the domestic immunoassay market, leveraging economies of scale and extensive distribution networks. Read More @ https://www.polarismarketresearch.com/industry-analysis/japan-immunoassay-market Strategic positioning is further enhanced by corporate expansions and international partnerships. Fujirebio’s acquisition of Miraca Holdings’ diagnostics division strengthened its oncology portfolio and expanded its global footprint. Similarly, Sysmex has expanded into AI-driven hematology and immunoassay analytics through collaborations with cloud diagnostics firms, positioning itself at the forefront of digital pathology. These moves reflect a broader trend of market consolidation, where scale and technological differentiation determine long-term competitiveness. Trade policies within the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) also facilitate smoother export of immunoassay equipment to Canada, Australia, and Mexico, reducing tariffs and regulatory barriers. Competitive Landscape: • Sysmex Corporation • Fujirebio Inc. • Roche Diagnostics K.K. • Abbott Japan Co., Ltd. • Siemens Healthineers K.K. • Beckman Coulter, Inc. • Ortho Clinical Diagnostics • Thermo Fisher Scientific K.K. More Trending Latest Reports By Polaris Market Research: Sorbitol Market Formulation Development Outsourcing Market Freight Wagon Market Healthcare Supply Chain Management Market Azimuth Thrusters Market Cell Signaling Market Europe Digestive Health Supplements Market Prepreg Market Tactical Communication Market0 Σχόλια ·0 Μοιράστηκε ·115 Views ·0 Προεπισκόπηση -

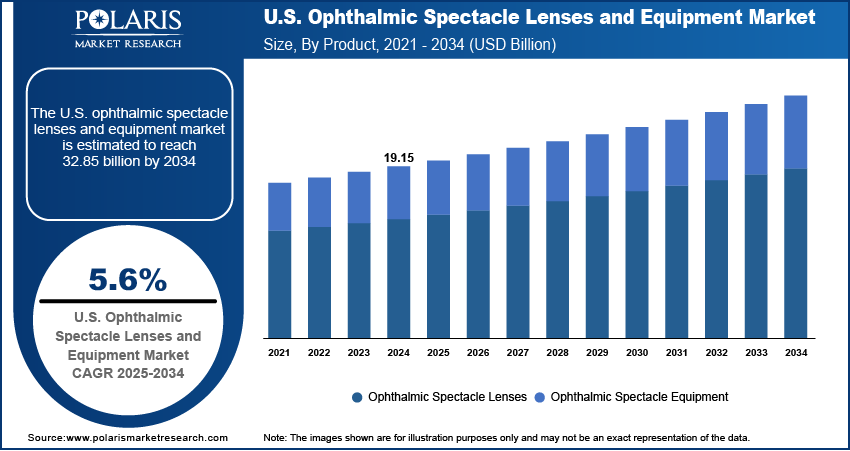

The U.S. ophthalmic spectacle lenses and equipment market, valued at USD 19.15 billion in 2024 and projected to grow at a 5.6% CAGR through 2034, reflects the country’s dominant position in the global vision care industry, driven by strong national policy impact, R&D leadership, and deep integration into international healthcare ecosystems. The U.S. ranks as the largest single market for ophthalmic devices, surpassing Germany, China, and Japan in total revenue, benefiting from a highly commercialized optometry sector, strong intellectual property protections, and government-backed initiatives that promote technological innovation. The National Institutes of Health (NIH) and the National Eye Institute (NEI) fund extensive research into vision science, directly influencing R&D investments in next-generation lenses, diagnostic imaging, and gene therapies for inherited retinal diseases. This national policy impact is reinforced by the FDA’s Breakthrough Devices Program, which accelerates the approval of innovative ophthalmic technologies, giving U.S.-based firms a first-mover advantage.

The country’s local manufacturing bases in California, Florida, and New York are home to innovation hubs where firms like Johnson & Johnson Vision, Alcon, and EssilorLuxottica conduct cutting-edge research in high-index lens materials, anti-reflective coatings, and digital surfacing technologies. These clusters benefit from proximity to academic institutions such as MIT, Johns Hopkins, and Stanford, enabling rapid translation of scientific discoveries into commercial products. The emphasis on precision engineering and quality control gives U.S. manufacturers a distinct tech advantage in producing complex, high-performance lenses that are difficult to replicate in low-cost manufacturing regions. Market share concentration is evident in the dominance of EssilorLuxottica, which controls over 35% of the domestic spectacle lens market, leveraging economies of scale and extensive distribution networks.

Read More @ https://www.polarismarketresearch.com/industry-analysis/us-ophthalmic-spectacle-lenses-and-equipment-market

Strategic positioning is further enhanced by corporate expansions and international partnerships. EssilorLuxottica’s acquisition of Supreme Optical strengthened its presence in the independent optician channel, while Alcon’s investment in AI-powered cataract surgery planning platforms positions it at the forefront of digital eye care. These moves reflect a broader trend of market consolidation, where scale and technological differentiation determine long-term competitiveness. Trade policies under the USMCA also facilitate smoother export of ophthalmic equipment to Canada and Mexico, reducing tariffs and regulatory barriers.

Competitive Landscape:

• EssilorLuxottica

• Johnson & Johnson Vision

• Carl Zeiss Vision

• Hoya Corporation

• Safilo Group S.p.A.

• Alcon Inc.

• Nikon-Essilor

• Bausch + Lomb Corporation

More Trending Latest Reports By Polaris Market Research:

Sorbitol Market

catheter market

Freight Wagon Market

Healthcare Supply Chain Management Market

Azimuth Thrusters Market

Cell Signaling Market

Therapeutic Hypothermia Systems Market

Prepreg Market

Tactical Communication Market

The U.S. ophthalmic spectacle lenses and equipment market, valued at USD 19.15 billion in 2024 and projected to grow at a 5.6% CAGR through 2034, reflects the country’s dominant position in the global vision care industry, driven by strong national policy impact, R&D leadership, and deep integration into international healthcare ecosystems. The U.S. ranks as the largest single market for ophthalmic devices, surpassing Germany, China, and Japan in total revenue, benefiting from a highly commercialized optometry sector, strong intellectual property protections, and government-backed initiatives that promote technological innovation. The National Institutes of Health (NIH) and the National Eye Institute (NEI) fund extensive research into vision science, directly influencing R&D investments in next-generation lenses, diagnostic imaging, and gene therapies for inherited retinal diseases. This national policy impact is reinforced by the FDA’s Breakthrough Devices Program, which accelerates the approval of innovative ophthalmic technologies, giving U.S.-based firms a first-mover advantage. The country’s local manufacturing bases in California, Florida, and New York are home to innovation hubs where firms like Johnson & Johnson Vision, Alcon, and EssilorLuxottica conduct cutting-edge research in high-index lens materials, anti-reflective coatings, and digital surfacing technologies. These clusters benefit from proximity to academic institutions such as MIT, Johns Hopkins, and Stanford, enabling rapid translation of scientific discoveries into commercial products. The emphasis on precision engineering and quality control gives U.S. manufacturers a distinct tech advantage in producing complex, high-performance lenses that are difficult to replicate in low-cost manufacturing regions. Market share concentration is evident in the dominance of EssilorLuxottica, which controls over 35% of the domestic spectacle lens market, leveraging economies of scale and extensive distribution networks. Read More @ https://www.polarismarketresearch.com/industry-analysis/us-ophthalmic-spectacle-lenses-and-equipment-market Strategic positioning is further enhanced by corporate expansions and international partnerships. EssilorLuxottica’s acquisition of Supreme Optical strengthened its presence in the independent optician channel, while Alcon’s investment in AI-powered cataract surgery planning platforms positions it at the forefront of digital eye care. These moves reflect a broader trend of market consolidation, where scale and technological differentiation determine long-term competitiveness. Trade policies under the USMCA also facilitate smoother export of ophthalmic equipment to Canada and Mexico, reducing tariffs and regulatory barriers. Competitive Landscape: • EssilorLuxottica • Johnson & Johnson Vision • Carl Zeiss Vision • Hoya Corporation • Safilo Group S.p.A. • Alcon Inc. • Nikon-Essilor • Bausch + Lomb Corporation More Trending Latest Reports By Polaris Market Research: Sorbitol Market catheter market Freight Wagon Market Healthcare Supply Chain Management Market Azimuth Thrusters Market Cell Signaling Market Therapeutic Hypothermia Systems Market Prepreg Market Tactical Communication Market0 Σχόλια ·0 Μοιράστηκε ·120 Views ·0 Προεπισκόπηση -

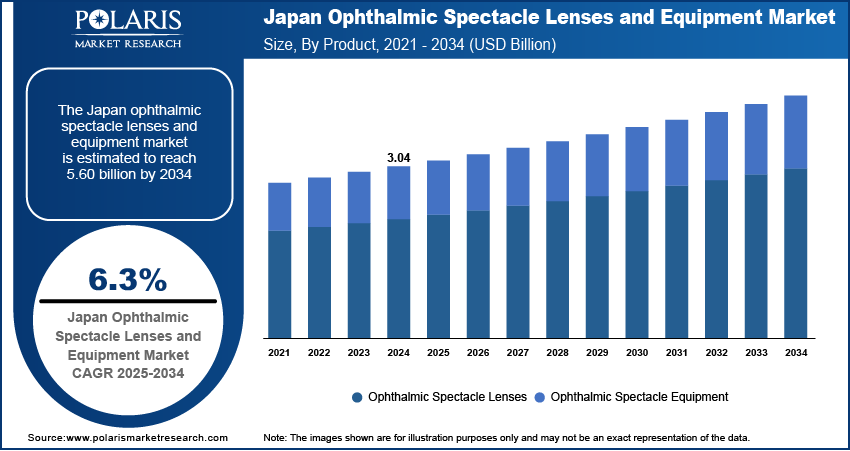

The Japan ophthalmic spectacle lenses and equipment market, valued at USD 3.04 billion in 2024 and projected to grow at a 6.3% CAGR through 2034, reflects the country’s strategic positioning as a global leader in optical innovation, driven by strong national policy impact, R&D leadership, and deep integration into international healthcare ecosystems. Japan ranks among the top five global markets for ophthalmic devices, alongside the U.S., Germany, China, and France, benefiting from a highly skilled workforce, advanced manufacturing capabilities, and government-backed initiatives that promote technological self-reliance. The Society 5.0 initiative, launched by the Cabinet Office, emphasizes the fusion of physical and digital technologies, directly influencing R&D investments in smart lenses, AI-driven diagnostics, and tele-optometry platforms. This national policy impact is reinforced by the Ministry of Economy, Trade and Industry (METI), which provides grants and tax incentives for companies developing next-generation medical devices.

Japan’s local manufacturing bases in Kanagawa, Osaka, and Aichi are home to innovation hubs where firms like Hoya, Topcon, and Nikon-Essilor conduct cutting-edge research in high-index lens materials, anti-reflective coatings, and digital surfacing technologies. These clusters benefit from close collaboration with academic institutions such as the University of Tokyo and Kyoto University, enabling rapid translation of scientific discoveries into commercial products. The country’s emphasis on precision engineering and quality control gives it a distinct tech advantage in producing complex, high-performance lenses that are difficult to replicate in low-cost manufacturing regions. Market share concentration is evident in the dominance of Hoya and Nikon-Essilor, which together control over 50% of the domestic spectacle lens market, leveraging economies of scale and extensive distribution networks.

Read More @ https://www.polarismarketresearch.com/industry-analysis/japan-ophthalmic-spectacle-lenses-and-equipment-market

Strategic positioning is further enhanced by corporate expansions and international partnerships. Hoya’s acquisition of Solamer, a U.S.-based lens coating specialist, strengthened its global footprint and enhanced its anti-reflective technology portfolio. Similarly, Topcon has expanded into AI-powered retinal imaging through collaborations with cloud diagnostics firms, positioning itself at the forefront of digital eye care. These moves reflect a broader trend of market consolidation, where scale and technological differentiation determine long-term competitiveness. Trade policies within the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) also facilitate smoother export of ophthalmic equipment to Canada, Australia, and Mexico, reducing tariffs and regulatory barriers.

The Japan ophthalmic spectacle lenses and equipment market, valued at USD 3.04 billion in 2024 and projected to grow at a 6.3% CAGR through 2034, reflects the country’s strategic positioning as a global leader in optical innovation, driven by strong national policy impact, R&D leadership, and deep integration into international healthcare ecosystems. Japan ranks among the top five global markets for ophthalmic devices, alongside the U.S., Germany, China, and France, benefiting from a highly skilled workforce, advanced manufacturing capabilities, and government-backed initiatives that promote technological self-reliance. The Society 5.0 initiative, launched by the Cabinet Office, emphasizes the fusion of physical and digital technologies, directly influencing R&D investments in smart lenses, AI-driven diagnostics, and tele-optometry platforms. This national policy impact is reinforced by the Ministry of Economy, Trade and Industry (METI), which provides grants and tax incentives for companies developing next-generation medical devices. Japan’s local manufacturing bases in Kanagawa, Osaka, and Aichi are home to innovation hubs where firms like Hoya, Topcon, and Nikon-Essilor conduct cutting-edge research in high-index lens materials, anti-reflective coatings, and digital surfacing technologies. These clusters benefit from close collaboration with academic institutions such as the University of Tokyo and Kyoto University, enabling rapid translation of scientific discoveries into commercial products. The country’s emphasis on precision engineering and quality control gives it a distinct tech advantage in producing complex, high-performance lenses that are difficult to replicate in low-cost manufacturing regions. Market share concentration is evident in the dominance of Hoya and Nikon-Essilor, which together control over 50% of the domestic spectacle lens market, leveraging economies of scale and extensive distribution networks. Read More @ https://www.polarismarketresearch.com/industry-analysis/japan-ophthalmic-spectacle-lenses-and-equipment-market Strategic positioning is further enhanced by corporate expansions and international partnerships. Hoya’s acquisition of Solamer, a U.S.-based lens coating specialist, strengthened its global footprint and enhanced its anti-reflective technology portfolio. Similarly, Topcon has expanded into AI-powered retinal imaging through collaborations with cloud diagnostics firms, positioning itself at the forefront of digital eye care. These moves reflect a broader trend of market consolidation, where scale and technological differentiation determine long-term competitiveness. Trade policies within the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) also facilitate smoother export of ophthalmic equipment to Canada, Australia, and Mexico, reducing tariffs and regulatory barriers.0 Σχόλια ·0 Μοιράστηκε ·66 Views ·0 Προεπισκόπηση -

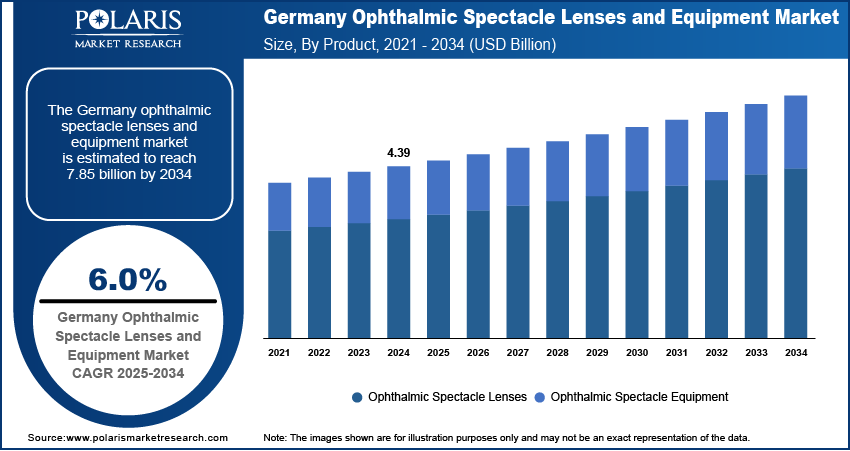

The Germany ophthalmic spectacle lenses and equipment market, valued at USD 4.39 billion in 2024 and projected to grow at a 6.0% CAGR through 2034, reflects the country’s pivotal role in shaping global vision care standards through innovation, regulatory influence, and industrial excellence. As one of the top three ophthalmic markets in Europe—alongside France and the UK—Germany benefits from a highly skilled workforce, a dense network of research institutions, and strong national policy impact that prioritizes healthcare quality and technological advancement. The Federal Institute for Drugs and Medical Devices (BfArM) enforces rigorous compliance standards, ensuring that both domestic and imported products meet high safety and performance benchmarks, thereby reinforcing consumer confidence and market integrity.

Germany’s leadership is further amplified by its status as a global hub for R&D leadership in optical engineering, with companies like Carl Zeiss Vision and Rodenstock investing heavily in material science, digital lens design, and AI-driven diagnostics. These firms operate innovation centers in collaboration with universities and Fraunhofer institutes, accelerating the development of high-index, lightweight lenses and smart eyewear prototypes. The country’s local manufacturing bases in Bavaria and Rhineland are supported by a robust supply chain of precision tooling and coating specialists, enabling rapid prototyping and scalable production. This ecosystem gives German manufacturers a distinct tech advantage in producing complex, high-precision lenses that are difficult to replicate in low-cost regions.

Read More @ https://www.polarismarketresearch.com/industry-analysis/germany-ophthalmic-spectacle-lenses-and-equipment-market

Strategic positioning is evident in corporate expansion strategies, where German firms are leveraging their reputation for quality to penetrate high-growth markets in Asia and Eastern Europe. EssilorLuxottica’s acquisition of a controlling stake in Rodenstock in 2021 exemplifies market share concentration, allowing for greater economies of scale and enhanced distribution reach. Similarly, Zeiss has expanded its digital eye care platforms into China and India, where rising middle-class demand for premium vision solutions is creating new revenue streams. These moves are supported by favorable trade policies within the EU single market, which facilitate cross-border equipment sales and service integration.