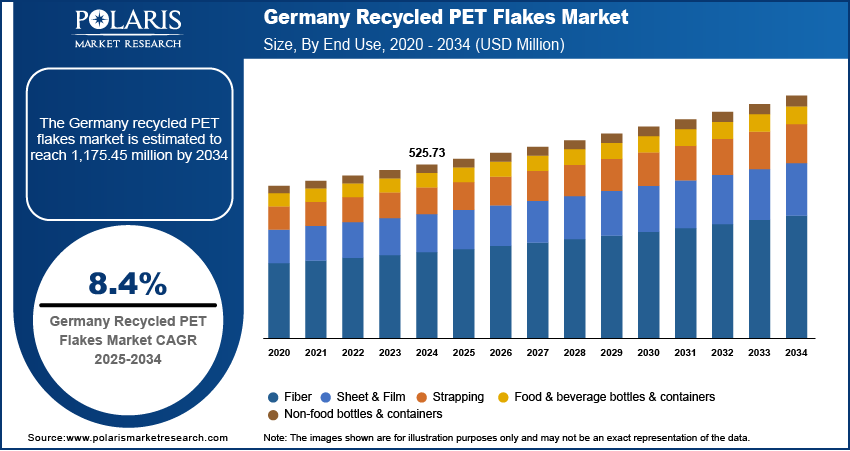

The Germany recycled PET (rPET) flakes market, valued at USD 525.73 million in 2024, is projected to grow at a compound annual growth rate (CAGR) of 8.4% from 2025 to 2034, driven by stringent environmental regulations, robust circular economy policies, and rising corporate sustainability mandates. As Europe’s largest economy and a leader in environmental governance, Germany plays a pivotal role in shaping the regional and global rPET landscape. The country’s influence extends beyond its borders, impacting regional manufacturing trends, cross-border supply chains, and market penetration strategies across Europe, North America, and Asia Pacific. Germany’s advanced waste management infrastructure and high consumer awareness of plastic pollution have positioned it as a benchmark for recycling efficiency and regulatory innovation.

Within Europe, Germany operates under the Extended Producer Responsibility (EPR) framework established by the German Packaging Act (Verpackungsgesetz), which mandates that producers finance the collection, sorting, and recycling of packaging waste. This national policy impact ensures a stable supply of post-consumer PET bottles, with a recycling rate exceeding 97% for deposit-bearing containers—among the highest in the world. The dual system managed by Der Grüne Punkt (DSD) and other compliance schemes ensures efficient collection and sorting, providing high-purity feedstock for rPET flake producers. Regional manufacturing trends in Germany emphasize automation, traceability, and integration with downstream industries such as beverage bottling and textile manufacturing. German recyclers are increasingly investing in near-infrared (NIR) sorting, advanced washing lines, and solid-state polymerization (SSP) to meet food-grade specifications, aligning with European Food Safety Authority (EFSA) standards.

Cross-border supply chains are a critical component of Germany’s rPET ecosystem. While the country is largely self-sufficient in PET collection, it imports secondary raw materials such as baled PET from neighboring countries including Poland, Austria, and the Netherlands to optimize processing capacity. Conversely, Germany exports high-quality rPET flakes to countries with insufficient domestic recycling infrastructure, including Italy, Spain, and parts of Eastern Europe. These flows are shaped by the European Union’s Circular Economy Action Plan and the Packaging and Packaging Waste Regulation (PPWR), which will require PET bottles to contain 30% recycled content by 2030. This regulatory tailwind is driving market penetration strategies focused on long-term supply agreements with multinational brand owners such as Coca-Cola, Nestlé, and Unilever, all of which have committed to increasing rPET usage in their packaging.

Read More @ https://www.polarismarketresearch.com/industry-analysis/germany-recycled-pet-flakes-market

In North America, the rPET market is expanding due to state-level container deposit laws and corporate ESG goals, but faces challenges related to fragmented collection systems and lower recycling rates. U.S. firms are increasingly looking to German recycling facilities for technology transfer and process optimization, particularly in food-grade recycling and decontamination. Meanwhile, in Asia Pacific, countries like China and Japan are advancing their domestic recycling capabilities, but still rely on European expertise for high-purity flake production. Germany’s role as a technology exporter and process innovator enhances its strategic positioning in global supply chains, particularly in licensing advanced sorting and washing systems to emerging markets.

Market drivers include regulatory mandates, brand owner sustainability commitments, and rising landfill and incineration costs. However, restraints such as contamination in mixed waste streams, fluctuating virgin PET prices, and energy-intensive recycling processes limit profitability. Opportunities lie in scaling chemical recycling technologies—such as glycolysis and methanolysis—enabling the processing of mixed or colored PET waste unsuitable for mechanical recycling. Trends such as digital watermarking for improved sorting accuracy, blockchain-based material tracing, and industrial symbiosis—where waste heat and byproducts are reused across facilities—are gaining traction, particularly in industrial clusters around Frankfurt, Hamburg, and Leipzig.

The competitive landscape is dominated by integrated waste management firms, specialized recyclers, and petrochemical companies with downstream processing capabilities.

Within Europe, Germany operates under the Extended Producer Responsibility (EPR) framework established by the German Packaging Act (Verpackungsgesetz), which mandates that producers finance the collection, sorting, and recycling of packaging waste. This national policy impact ensures a stable supply of post-consumer PET bottles, with a recycling rate exceeding 97% for deposit-bearing containers—among the highest in the world. The dual system managed by Der Grüne Punkt (DSD) and other compliance schemes ensures efficient collection and sorting, providing high-purity feedstock for rPET flake producers. Regional manufacturing trends in Germany emphasize automation, traceability, and integration with downstream industries such as beverage bottling and textile manufacturing. German recyclers are increasingly investing in near-infrared (NIR) sorting, advanced washing lines, and solid-state polymerization (SSP) to meet food-grade specifications, aligning with European Food Safety Authority (EFSA) standards.

Cross-border supply chains are a critical component of Germany’s rPET ecosystem. While the country is largely self-sufficient in PET collection, it imports secondary raw materials such as baled PET from neighboring countries including Poland, Austria, and the Netherlands to optimize processing capacity. Conversely, Germany exports high-quality rPET flakes to countries with insufficient domestic recycling infrastructure, including Italy, Spain, and parts of Eastern Europe. These flows are shaped by the European Union’s Circular Economy Action Plan and the Packaging and Packaging Waste Regulation (PPWR), which will require PET bottles to contain 30% recycled content by 2030. This regulatory tailwind is driving market penetration strategies focused on long-term supply agreements with multinational brand owners such as Coca-Cola, Nestlé, and Unilever, all of which have committed to increasing rPET usage in their packaging.

Read More @ https://www.polarismarketresearch.com/industry-analysis/germany-recycled-pet-flakes-market

In North America, the rPET market is expanding due to state-level container deposit laws and corporate ESG goals, but faces challenges related to fragmented collection systems and lower recycling rates. U.S. firms are increasingly looking to German recycling facilities for technology transfer and process optimization, particularly in food-grade recycling and decontamination. Meanwhile, in Asia Pacific, countries like China and Japan are advancing their domestic recycling capabilities, but still rely on European expertise for high-purity flake production. Germany’s role as a technology exporter and process innovator enhances its strategic positioning in global supply chains, particularly in licensing advanced sorting and washing systems to emerging markets.

Market drivers include regulatory mandates, brand owner sustainability commitments, and rising landfill and incineration costs. However, restraints such as contamination in mixed waste streams, fluctuating virgin PET prices, and energy-intensive recycling processes limit profitability. Opportunities lie in scaling chemical recycling technologies—such as glycolysis and methanolysis—enabling the processing of mixed or colored PET waste unsuitable for mechanical recycling. Trends such as digital watermarking for improved sorting accuracy, blockchain-based material tracing, and industrial symbiosis—where waste heat and byproducts are reused across facilities—are gaining traction, particularly in industrial clusters around Frankfurt, Hamburg, and Leipzig.

The competitive landscape is dominated by integrated waste management firms, specialized recyclers, and petrochemical companies with downstream processing capabilities.

The Germany recycled PET (rPET) flakes market, valued at USD 525.73 million in 2024, is projected to grow at a compound annual growth rate (CAGR) of 8.4% from 2025 to 2034, driven by stringent environmental regulations, robust circular economy policies, and rising corporate sustainability mandates. As Europe’s largest economy and a leader in environmental governance, Germany plays a pivotal role in shaping the regional and global rPET landscape. The country’s influence extends beyond its borders, impacting regional manufacturing trends, cross-border supply chains, and market penetration strategies across Europe, North America, and Asia Pacific. Germany’s advanced waste management infrastructure and high consumer awareness of plastic pollution have positioned it as a benchmark for recycling efficiency and regulatory innovation.

Within Europe, Germany operates under the Extended Producer Responsibility (EPR) framework established by the German Packaging Act (Verpackungsgesetz), which mandates that producers finance the collection, sorting, and recycling of packaging waste. This national policy impact ensures a stable supply of post-consumer PET bottles, with a recycling rate exceeding 97% for deposit-bearing containers—among the highest in the world. The dual system managed by Der Grüne Punkt (DSD) and other compliance schemes ensures efficient collection and sorting, providing high-purity feedstock for rPET flake producers. Regional manufacturing trends in Germany emphasize automation, traceability, and integration with downstream industries such as beverage bottling and textile manufacturing. German recyclers are increasingly investing in near-infrared (NIR) sorting, advanced washing lines, and solid-state polymerization (SSP) to meet food-grade specifications, aligning with European Food Safety Authority (EFSA) standards.

Cross-border supply chains are a critical component of Germany’s rPET ecosystem. While the country is largely self-sufficient in PET collection, it imports secondary raw materials such as baled PET from neighboring countries including Poland, Austria, and the Netherlands to optimize processing capacity. Conversely, Germany exports high-quality rPET flakes to countries with insufficient domestic recycling infrastructure, including Italy, Spain, and parts of Eastern Europe. These flows are shaped by the European Union’s Circular Economy Action Plan and the Packaging and Packaging Waste Regulation (PPWR), which will require PET bottles to contain 30% recycled content by 2030. This regulatory tailwind is driving market penetration strategies focused on long-term supply agreements with multinational brand owners such as Coca-Cola, Nestlé, and Unilever, all of which have committed to increasing rPET usage in their packaging.

Read More @ https://www.polarismarketresearch.com/industry-analysis/germany-recycled-pet-flakes-market

In North America, the rPET market is expanding due to state-level container deposit laws and corporate ESG goals, but faces challenges related to fragmented collection systems and lower recycling rates. U.S. firms are increasingly looking to German recycling facilities for technology transfer and process optimization, particularly in food-grade recycling and decontamination. Meanwhile, in Asia Pacific, countries like China and Japan are advancing their domestic recycling capabilities, but still rely on European expertise for high-purity flake production. Germany’s role as a technology exporter and process innovator enhances its strategic positioning in global supply chains, particularly in licensing advanced sorting and washing systems to emerging markets.

Market drivers include regulatory mandates, brand owner sustainability commitments, and rising landfill and incineration costs. However, restraints such as contamination in mixed waste streams, fluctuating virgin PET prices, and energy-intensive recycling processes limit profitability. Opportunities lie in scaling chemical recycling technologies—such as glycolysis and methanolysis—enabling the processing of mixed or colored PET waste unsuitable for mechanical recycling. Trends such as digital watermarking for improved sorting accuracy, blockchain-based material tracing, and industrial symbiosis—where waste heat and byproducts are reused across facilities—are gaining traction, particularly in industrial clusters around Frankfurt, Hamburg, and Leipzig.

The competitive landscape is dominated by integrated waste management firms, specialized recyclers, and petrochemical companies with downstream processing capabilities.

0 التعليقات

·0 المشاركات

·95 مشاهدة

·0 معاينة