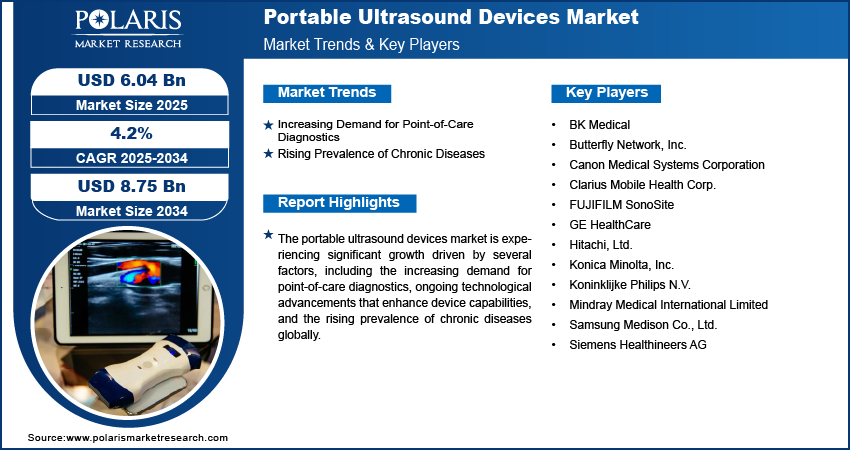

The global portable ultrasound devices market, valued at USD 5.81 billion in 2024, is projected to grow at a compound annual growth rate (CAGR) of 4.2% from 2025 to 2034, driven by the increasing demand for point-of-care diagnostics, rising healthcare accessibility needs, and advancements in miniaturization and imaging technology. This growth is not evenly distributed across geographies; rather, it is shaped by distinct regional manufacturing trends, regulatory frameworks, and evolving cross-border supply chain dynamics. North America, Europe, and Asia Pacific are emerging as pivotal markets, each navigating unique challenges and opportunities in the adoption and deployment of portable ultrasound systems.

In North America, particularly the United States, the market is the most mature, supported by a robust healthcare infrastructure, high physician adoption rates, and favorable reimbursement policies for diagnostic imaging. The U.S. Food and Drug Administration (FDA) maintains a well-established regulatory pathway for 510(k) clearance of portable ultrasound devices, enabling rapid commercialization of new entrants. Regional manufacturing trends show a shift toward domestic production of critical components, particularly in response to supply chain disruptions during the pandemic. Companies are increasingly investing in localized assembly and quality control to ensure compliance and reduce lead times. Market penetration strategies in the U.S. emphasize integration with electronic health records (EHRs), cloud-based image storage, and AI-powered interpretation tools, enhancing clinical utility and workflow efficiency in emergency departments, intensive care units, and outpatient clinics.

Europe presents a more fragmented but highly regulated landscape, with the European Union’s Medical Device Regulation (MDR) imposing stringent conformity assessment requirements. Countries such as Germany, France, and the United Kingdom lead in clinical adoption, particularly in anesthesia, critical care, and musculoskeletal applications. However, cross-border supply chains face challenges due to varying national reimbursement policies and procurement models. The EU’s emphasis on health technology assessment (HTA) requires manufacturers to demonstrate clinical and economic value, influencing pricing and market access strategies. Despite these hurdles, European firms are investing in regional manufacturing trends that emphasize energy efficiency, recyclable materials, and interoperability with existing hospital IT systems. Market penetration strategies often involve public-private partnerships, training programs for clinicians, and participation in national telemedicine initiatives to expand access in rural and underserved areas.

Read More @ https://www.polarismarketresearch.com/industry-analysis/portable-ultrasound-devices-market

Asia Pacific is witnessing accelerated growth, particularly in China, India, and Japan, where aging populations, rising chronic disease prevalence, and government-led healthcare modernization are driving demand. China’s “Healthy China 2030” initiative has prioritized medical device self-sufficiency, creating opportunities for domestic manufacturers to compete with multinational players. The country’s regional manufacturing trends are characterized by vertical integration, with firms producing transducers, processors, and software in-house to reduce costs and improve scalability. India is expanding its diagnostic infrastructure under the Ayushman Bharat scheme, creating demand for affordable, rugged portable ultrasound devices suitable for primary health centers. Market penetration strategies in the region often involve tiered pricing, mobile-first platforms, and collaborations with NGOs and government agencies to reach remote populations.

Market drivers include the growing burden of cardiovascular and abdominal diseases, increasing use of ultrasound in emergency medicine, and the shift toward decentralized care models. However, restraints such as high device costs, limited reimbursement in low- and middle-income countries, and shortage of trained sonographers limit widespread adoption. Opportunities lie in AI-driven image interpretation, integration with wearable sensors, and expansion into veterinary and home healthcare applications. Trends such as handheld device proliferation, real-time remote guidance, and blockchain-enabled image security are redefining the value proposition of portable ultrasound across diverse clinical settings.

The competitive landscape is dominated by a select group of global players with strong R&D capabilities, regulatory expertise, and extensive distribution networks.

In North America, particularly the United States, the market is the most mature, supported by a robust healthcare infrastructure, high physician adoption rates, and favorable reimbursement policies for diagnostic imaging. The U.S. Food and Drug Administration (FDA) maintains a well-established regulatory pathway for 510(k) clearance of portable ultrasound devices, enabling rapid commercialization of new entrants. Regional manufacturing trends show a shift toward domestic production of critical components, particularly in response to supply chain disruptions during the pandemic. Companies are increasingly investing in localized assembly and quality control to ensure compliance and reduce lead times. Market penetration strategies in the U.S. emphasize integration with electronic health records (EHRs), cloud-based image storage, and AI-powered interpretation tools, enhancing clinical utility and workflow efficiency in emergency departments, intensive care units, and outpatient clinics.

Europe presents a more fragmented but highly regulated landscape, with the European Union’s Medical Device Regulation (MDR) imposing stringent conformity assessment requirements. Countries such as Germany, France, and the United Kingdom lead in clinical adoption, particularly in anesthesia, critical care, and musculoskeletal applications. However, cross-border supply chains face challenges due to varying national reimbursement policies and procurement models. The EU’s emphasis on health technology assessment (HTA) requires manufacturers to demonstrate clinical and economic value, influencing pricing and market access strategies. Despite these hurdles, European firms are investing in regional manufacturing trends that emphasize energy efficiency, recyclable materials, and interoperability with existing hospital IT systems. Market penetration strategies often involve public-private partnerships, training programs for clinicians, and participation in national telemedicine initiatives to expand access in rural and underserved areas.

Read More @ https://www.polarismarketresearch.com/industry-analysis/portable-ultrasound-devices-market

Asia Pacific is witnessing accelerated growth, particularly in China, India, and Japan, where aging populations, rising chronic disease prevalence, and government-led healthcare modernization are driving demand. China’s “Healthy China 2030” initiative has prioritized medical device self-sufficiency, creating opportunities for domestic manufacturers to compete with multinational players. The country’s regional manufacturing trends are characterized by vertical integration, with firms producing transducers, processors, and software in-house to reduce costs and improve scalability. India is expanding its diagnostic infrastructure under the Ayushman Bharat scheme, creating demand for affordable, rugged portable ultrasound devices suitable for primary health centers. Market penetration strategies in the region often involve tiered pricing, mobile-first platforms, and collaborations with NGOs and government agencies to reach remote populations.

Market drivers include the growing burden of cardiovascular and abdominal diseases, increasing use of ultrasound in emergency medicine, and the shift toward decentralized care models. However, restraints such as high device costs, limited reimbursement in low- and middle-income countries, and shortage of trained sonographers limit widespread adoption. Opportunities lie in AI-driven image interpretation, integration with wearable sensors, and expansion into veterinary and home healthcare applications. Trends such as handheld device proliferation, real-time remote guidance, and blockchain-enabled image security are redefining the value proposition of portable ultrasound across diverse clinical settings.

The competitive landscape is dominated by a select group of global players with strong R&D capabilities, regulatory expertise, and extensive distribution networks.

The global portable ultrasound devices market, valued at USD 5.81 billion in 2024, is projected to grow at a compound annual growth rate (CAGR) of 4.2% from 2025 to 2034, driven by the increasing demand for point-of-care diagnostics, rising healthcare accessibility needs, and advancements in miniaturization and imaging technology. This growth is not evenly distributed across geographies; rather, it is shaped by distinct regional manufacturing trends, regulatory frameworks, and evolving cross-border supply chain dynamics. North America, Europe, and Asia Pacific are emerging as pivotal markets, each navigating unique challenges and opportunities in the adoption and deployment of portable ultrasound systems.

In North America, particularly the United States, the market is the most mature, supported by a robust healthcare infrastructure, high physician adoption rates, and favorable reimbursement policies for diagnostic imaging. The U.S. Food and Drug Administration (FDA) maintains a well-established regulatory pathway for 510(k) clearance of portable ultrasound devices, enabling rapid commercialization of new entrants. Regional manufacturing trends show a shift toward domestic production of critical components, particularly in response to supply chain disruptions during the pandemic. Companies are increasingly investing in localized assembly and quality control to ensure compliance and reduce lead times. Market penetration strategies in the U.S. emphasize integration with electronic health records (EHRs), cloud-based image storage, and AI-powered interpretation tools, enhancing clinical utility and workflow efficiency in emergency departments, intensive care units, and outpatient clinics.

Europe presents a more fragmented but highly regulated landscape, with the European Union’s Medical Device Regulation (MDR) imposing stringent conformity assessment requirements. Countries such as Germany, France, and the United Kingdom lead in clinical adoption, particularly in anesthesia, critical care, and musculoskeletal applications. However, cross-border supply chains face challenges due to varying national reimbursement policies and procurement models. The EU’s emphasis on health technology assessment (HTA) requires manufacturers to demonstrate clinical and economic value, influencing pricing and market access strategies. Despite these hurdles, European firms are investing in regional manufacturing trends that emphasize energy efficiency, recyclable materials, and interoperability with existing hospital IT systems. Market penetration strategies often involve public-private partnerships, training programs for clinicians, and participation in national telemedicine initiatives to expand access in rural and underserved areas.

Read More @ https://www.polarismarketresearch.com/industry-analysis/portable-ultrasound-devices-market

Asia Pacific is witnessing accelerated growth, particularly in China, India, and Japan, where aging populations, rising chronic disease prevalence, and government-led healthcare modernization are driving demand. China’s “Healthy China 2030” initiative has prioritized medical device self-sufficiency, creating opportunities for domestic manufacturers to compete with multinational players. The country’s regional manufacturing trends are characterized by vertical integration, with firms producing transducers, processors, and software in-house to reduce costs and improve scalability. India is expanding its diagnostic infrastructure under the Ayushman Bharat scheme, creating demand for affordable, rugged portable ultrasound devices suitable for primary health centers. Market penetration strategies in the region often involve tiered pricing, mobile-first platforms, and collaborations with NGOs and government agencies to reach remote populations.

Market drivers include the growing burden of cardiovascular and abdominal diseases, increasing use of ultrasound in emergency medicine, and the shift toward decentralized care models. However, restraints such as high device costs, limited reimbursement in low- and middle-income countries, and shortage of trained sonographers limit widespread adoption. Opportunities lie in AI-driven image interpretation, integration with wearable sensors, and expansion into veterinary and home healthcare applications. Trends such as handheld device proliferation, real-time remote guidance, and blockchain-enabled image security are redefining the value proposition of portable ultrasound across diverse clinical settings.

The competitive landscape is dominated by a select group of global players with strong R&D capabilities, regulatory expertise, and extensive distribution networks.

0 Comments

·0 Shares

·125 Views

·0 Reviews