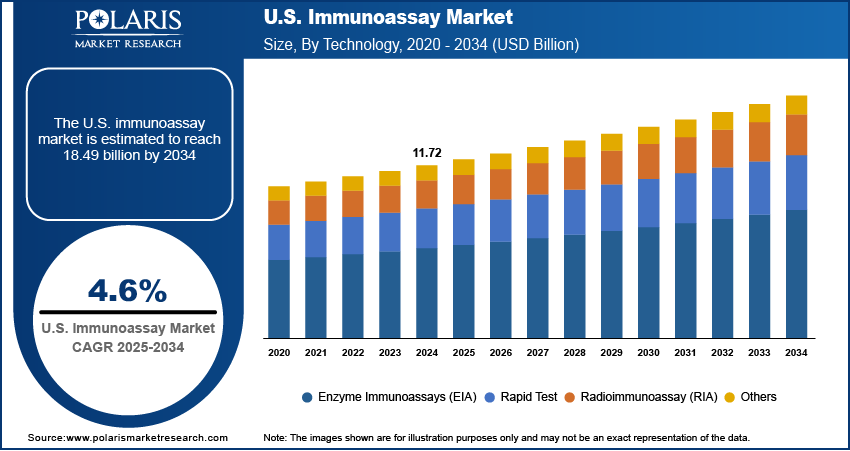

The U.S. immunoassay market, valued at USD 11.72 billion in 2024, is projected to grow at a CAGR of 4.6% from 2025 to 2034, with national policy impact, R&D leadership, and strategic positioning shaping the competitive dynamics across key geographies. While the United States remains the largest market, countries such as Germany, China, and Japan are playing increasingly influential roles through innovation hubs, local manufacturing bases, and supportive trade policies. These nations are not only major consumers but also critical contributors to global supply chains and technological advancement in immunoassay development.

The United States maintains its leadership through a combination of advanced healthcare infrastructure, strong intellectual property protection, and federal funding for biomedical research. National policy impact is evident in initiatives such as the National Institutes of Health (NIH) grants and the Biomedical Advanced Research and Development Authority (BARDA), which have accelerated the development of immunoassays for infectious diseases and biodefense. The FDA’s Breakthrough Devices Program has also expedited the approval of high-impact diagnostic platforms, reinforcing the U.S. as a hub for innovation. Major players such as Abbott and Thermo Fisher have leveraged this environment to launch next-generation immunoassay systems with enhanced sensitivity and automation.

Germany stands out in Europe for its engineering excellence and robust diagnostic industry. The country’s national policy impact includes funding for MedTech innovation through the Federal Ministry of Education and Research (BMBF), as well as strong collaboration between industry and academic institutions. German companies like Siemens Healthineers and Roche Diagnostics (with significant operations in Germany) are at the forefront of R&D leadership, particularly in high-precision immunoassay platforms and integrated lab solutions. Germany also serves as a key logistics node for cross-border supply chains, enabling efficient distribution across the EU.

Read More @ https://www.polarismarketresearch.com/industry-analysis/us-immunoassay-market

China is rapidly expanding its immunoassay capabilities, driven by government-backed initiatives to achieve self-reliance in critical medical technologies. The “Made in China 2025” and “14th Five-Year Plan” prioritize domestic production of diagnostic reagents and instruments, reducing reliance on foreign suppliers. Chinese firms such as Mindray and Autobio Diagnostics are investing heavily in R&D and forming strategic partnerships with global players to access advanced technologies. Local manufacturing bases are being expanded to meet growing domestic demand and to export to emerging markets in Asia, Africa, and Latin America.

Japan’s immunoassay market is characterized by high standards of quality and precision, supported by a strong tradition of engineering and biotechnology innovation. The Pharmaceuticals and Medical Devices Agency (PMDA) ensures rigorous validation of immunoassay products, fostering trust in clinical settings. Japanese companies like Fujirebio and Sysmex are known for their niche expertise in tumor markers and autoimmune testing, contributing to market share concentration in specialized segments.

Corporate strategies among top players are increasingly focused on mergers, expansions, and tech advantages. Abbott’s acquisition of St. Jude Medical and Thermo Fisher’s purchase of Qiagen have strengthened their diagnostic portfolios. Roche and Siemens are investing in AI-driven immunoassay interpretation and digital pathology integration, enhancing their strategic positioning. These moves reflect a broader trend of market share concentration, where scale, innovation, and global reach determine competitive success.

The United States maintains its leadership through a combination of advanced healthcare infrastructure, strong intellectual property protection, and federal funding for biomedical research. National policy impact is evident in initiatives such as the National Institutes of Health (NIH) grants and the Biomedical Advanced Research and Development Authority (BARDA), which have accelerated the development of immunoassays for infectious diseases and biodefense. The FDA’s Breakthrough Devices Program has also expedited the approval of high-impact diagnostic platforms, reinforcing the U.S. as a hub for innovation. Major players such as Abbott and Thermo Fisher have leveraged this environment to launch next-generation immunoassay systems with enhanced sensitivity and automation.

Germany stands out in Europe for its engineering excellence and robust diagnostic industry. The country’s national policy impact includes funding for MedTech innovation through the Federal Ministry of Education and Research (BMBF), as well as strong collaboration between industry and academic institutions. German companies like Siemens Healthineers and Roche Diagnostics (with significant operations in Germany) are at the forefront of R&D leadership, particularly in high-precision immunoassay platforms and integrated lab solutions. Germany also serves as a key logistics node for cross-border supply chains, enabling efficient distribution across the EU.

Read More @ https://www.polarismarketresearch.com/industry-analysis/us-immunoassay-market

China is rapidly expanding its immunoassay capabilities, driven by government-backed initiatives to achieve self-reliance in critical medical technologies. The “Made in China 2025” and “14th Five-Year Plan” prioritize domestic production of diagnostic reagents and instruments, reducing reliance on foreign suppliers. Chinese firms such as Mindray and Autobio Diagnostics are investing heavily in R&D and forming strategic partnerships with global players to access advanced technologies. Local manufacturing bases are being expanded to meet growing domestic demand and to export to emerging markets in Asia, Africa, and Latin America.

Japan’s immunoassay market is characterized by high standards of quality and precision, supported by a strong tradition of engineering and biotechnology innovation. The Pharmaceuticals and Medical Devices Agency (PMDA) ensures rigorous validation of immunoassay products, fostering trust in clinical settings. Japanese companies like Fujirebio and Sysmex are known for their niche expertise in tumor markers and autoimmune testing, contributing to market share concentration in specialized segments.

Corporate strategies among top players are increasingly focused on mergers, expansions, and tech advantages. Abbott’s acquisition of St. Jude Medical and Thermo Fisher’s purchase of Qiagen have strengthened their diagnostic portfolios. Roche and Siemens are investing in AI-driven immunoassay interpretation and digital pathology integration, enhancing their strategic positioning. These moves reflect a broader trend of market share concentration, where scale, innovation, and global reach determine competitive success.

The U.S. immunoassay market, valued at USD 11.72 billion in 2024, is projected to grow at a CAGR of 4.6% from 2025 to 2034, with national policy impact, R&D leadership, and strategic positioning shaping the competitive dynamics across key geographies. While the United States remains the largest market, countries such as Germany, China, and Japan are playing increasingly influential roles through innovation hubs, local manufacturing bases, and supportive trade policies. These nations are not only major consumers but also critical contributors to global supply chains and technological advancement in immunoassay development.

The United States maintains its leadership through a combination of advanced healthcare infrastructure, strong intellectual property protection, and federal funding for biomedical research. National policy impact is evident in initiatives such as the National Institutes of Health (NIH) grants and the Biomedical Advanced Research and Development Authority (BARDA), which have accelerated the development of immunoassays for infectious diseases and biodefense. The FDA’s Breakthrough Devices Program has also expedited the approval of high-impact diagnostic platforms, reinforcing the U.S. as a hub for innovation. Major players such as Abbott and Thermo Fisher have leveraged this environment to launch next-generation immunoassay systems with enhanced sensitivity and automation.

Germany stands out in Europe for its engineering excellence and robust diagnostic industry. The country’s national policy impact includes funding for MedTech innovation through the Federal Ministry of Education and Research (BMBF), as well as strong collaboration between industry and academic institutions. German companies like Siemens Healthineers and Roche Diagnostics (with significant operations in Germany) are at the forefront of R&D leadership, particularly in high-precision immunoassay platforms and integrated lab solutions. Germany also serves as a key logistics node for cross-border supply chains, enabling efficient distribution across the EU.

Read More @ https://www.polarismarketresearch.com/industry-analysis/us-immunoassay-market

China is rapidly expanding its immunoassay capabilities, driven by government-backed initiatives to achieve self-reliance in critical medical technologies. The “Made in China 2025” and “14th Five-Year Plan” prioritize domestic production of diagnostic reagents and instruments, reducing reliance on foreign suppliers. Chinese firms such as Mindray and Autobio Diagnostics are investing heavily in R&D and forming strategic partnerships with global players to access advanced technologies. Local manufacturing bases are being expanded to meet growing domestic demand and to export to emerging markets in Asia, Africa, and Latin America.

Japan’s immunoassay market is characterized by high standards of quality and precision, supported by a strong tradition of engineering and biotechnology innovation. The Pharmaceuticals and Medical Devices Agency (PMDA) ensures rigorous validation of immunoassay products, fostering trust in clinical settings. Japanese companies like Fujirebio and Sysmex are known for their niche expertise in tumor markers and autoimmune testing, contributing to market share concentration in specialized segments.

Corporate strategies among top players are increasingly focused on mergers, expansions, and tech advantages. Abbott’s acquisition of St. Jude Medical and Thermo Fisher’s purchase of Qiagen have strengthened their diagnostic portfolios. Roche and Siemens are investing in AI-driven immunoassay interpretation and digital pathology integration, enhancing their strategic positioning. These moves reflect a broader trend of market share concentration, where scale, innovation, and global reach determine competitive success.

0 Commenti

·0 condivisioni

·129 Views

·0 Anteprima