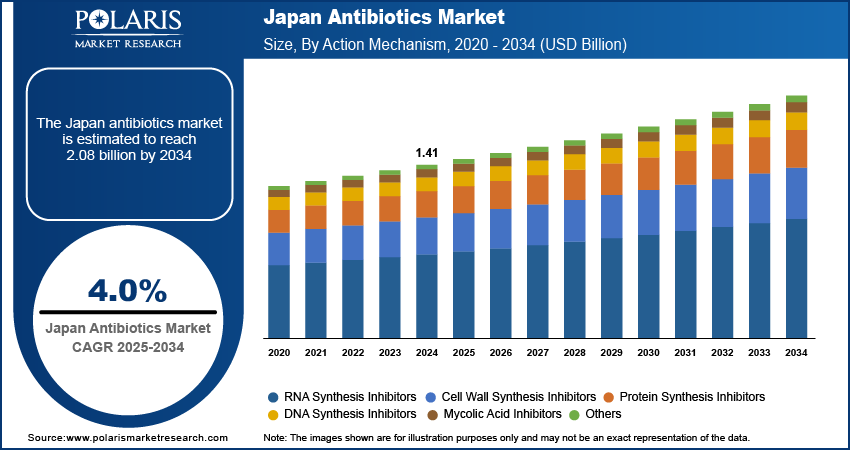

The Japan antibiotics market, valued at USD 1.41 billion in 2024, is anticipated to grow at a CAGR of 4.0% from 2025 to 2034, with segment-wise performance revealing distinct trajectories across drug classes, formulations, and clinical applications. The market is segmented primarily by therapeutic class—beta-lactams, fluoroquinolones, glycopeptides, macrolides, and newer agents such as oxazolidinones and tetracycline derivatives—each exhibiting unique demand patterns shaped by resistance profiles, safety considerations, and reimbursement status. Beta-lactams, particularly cephalosporins and carbapenems, dominate the hospital segment due to their broad-spectrum coverage and established role in treating severe infections, though their efficacy is increasingly challenged by ESBL-producing and carbapenemase-producing pathogens.

This has driven application-specific growth in combination therapies, such as ceftazidime-avibactam, which are gaining traction in intensive care units and oncology wards. Fluoroquinolones, once widely used, are experiencing declining prescriptions due to safety concerns, including tendon rupture and aortic aneurysm risks, leading to a shift toward alternative agents in respiratory and urinary tract infections. Glycopeptides like vancomycin remain a cornerstone for MRSA treatment, but their use is being optimized through therapeutic drug monitoring and dose adjustment protocols to minimize nephrotoxicity. In contrast, newer classes such as oxazolidinones (e.g., linezolid) and lipoglycopeptides (e.g., oritavancin) are witnessing robust growth due to their efficacy against resistant Gram-positive organisms and favorable pharmacokinetics, enabling shorter hospital stays and outpatient management.

Product differentiation is increasingly achieved through extended half-lives, reduced dosing frequency, and improved safety profiles, allowing for transition from intravenous to oral therapy and supporting Japan’s national push toward dehospitalization. Value chain optimization is a growing imperative, particularly among generic manufacturers like Meiji Seika and Takeda, who are investing in process efficiency, biosimilar development, and risk-based quality systems to maintain profitability amid pricing pressures. The hospital and long-term care segment accounts for over 60% of total market value, driven by Japan’s high elderly population and rising incidence of healthcare-associated infections.

Read More @ https://www.polarismarketresearch.com/industry-analysis/japan-antibiotics-market

Pricing dynamics are highly regulated under the National Health Insurance (NHI) framework, which conducts biennial price revisions, creating volatility for manufacturers and favoring companies with diversified portfolios and strong domestic pipelines. Opportunities exist in the development of narrow-spectrum antibiotics guided by rapid molecular diagnostics, which enable pathogen-specific treatment and align with antimicrobial stewardship goals. Additionally, the rise of antibiotic-adjuvant combinations and phage therapy research is opening new frontiers in application-specific growth. A critical trend is the integration of digital health tools—such as electronic prescribing alerts and antimicrobial stewardship software—into hospital workflows, which are improving prescribing accuracy and reducing inappropriate use. As resistance patterns evolve, the market is shifting from empirical to precision-based therapy, reshaping segment-wise performance and favoring companies with robust pipelines and diagnostic partnerships.

This has driven application-specific growth in combination therapies, such as ceftazidime-avibactam, which are gaining traction in intensive care units and oncology wards. Fluoroquinolones, once widely used, are experiencing declining prescriptions due to safety concerns, including tendon rupture and aortic aneurysm risks, leading to a shift toward alternative agents in respiratory and urinary tract infections. Glycopeptides like vancomycin remain a cornerstone for MRSA treatment, but their use is being optimized through therapeutic drug monitoring and dose adjustment protocols to minimize nephrotoxicity. In contrast, newer classes such as oxazolidinones (e.g., linezolid) and lipoglycopeptides (e.g., oritavancin) are witnessing robust growth due to their efficacy against resistant Gram-positive organisms and favorable pharmacokinetics, enabling shorter hospital stays and outpatient management.

Product differentiation is increasingly achieved through extended half-lives, reduced dosing frequency, and improved safety profiles, allowing for transition from intravenous to oral therapy and supporting Japan’s national push toward dehospitalization. Value chain optimization is a growing imperative, particularly among generic manufacturers like Meiji Seika and Takeda, who are investing in process efficiency, biosimilar development, and risk-based quality systems to maintain profitability amid pricing pressures. The hospital and long-term care segment accounts for over 60% of total market value, driven by Japan’s high elderly population and rising incidence of healthcare-associated infections.

Read More @ https://www.polarismarketresearch.com/industry-analysis/japan-antibiotics-market

Pricing dynamics are highly regulated under the National Health Insurance (NHI) framework, which conducts biennial price revisions, creating volatility for manufacturers and favoring companies with diversified portfolios and strong domestic pipelines. Opportunities exist in the development of narrow-spectrum antibiotics guided by rapid molecular diagnostics, which enable pathogen-specific treatment and align with antimicrobial stewardship goals. Additionally, the rise of antibiotic-adjuvant combinations and phage therapy research is opening new frontiers in application-specific growth. A critical trend is the integration of digital health tools—such as electronic prescribing alerts and antimicrobial stewardship software—into hospital workflows, which are improving prescribing accuracy and reducing inappropriate use. As resistance patterns evolve, the market is shifting from empirical to precision-based therapy, reshaping segment-wise performance and favoring companies with robust pipelines and diagnostic partnerships.

The Japan antibiotics market, valued at USD 1.41 billion in 2024, is anticipated to grow at a CAGR of 4.0% from 2025 to 2034, with segment-wise performance revealing distinct trajectories across drug classes, formulations, and clinical applications. The market is segmented primarily by therapeutic class—beta-lactams, fluoroquinolones, glycopeptides, macrolides, and newer agents such as oxazolidinones and tetracycline derivatives—each exhibiting unique demand patterns shaped by resistance profiles, safety considerations, and reimbursement status. Beta-lactams, particularly cephalosporins and carbapenems, dominate the hospital segment due to their broad-spectrum coverage and established role in treating severe infections, though their efficacy is increasingly challenged by ESBL-producing and carbapenemase-producing pathogens.

This has driven application-specific growth in combination therapies, such as ceftazidime-avibactam, which are gaining traction in intensive care units and oncology wards. Fluoroquinolones, once widely used, are experiencing declining prescriptions due to safety concerns, including tendon rupture and aortic aneurysm risks, leading to a shift toward alternative agents in respiratory and urinary tract infections. Glycopeptides like vancomycin remain a cornerstone for MRSA treatment, but their use is being optimized through therapeutic drug monitoring and dose adjustment protocols to minimize nephrotoxicity. In contrast, newer classes such as oxazolidinones (e.g., linezolid) and lipoglycopeptides (e.g., oritavancin) are witnessing robust growth due to their efficacy against resistant Gram-positive organisms and favorable pharmacokinetics, enabling shorter hospital stays and outpatient management.

Product differentiation is increasingly achieved through extended half-lives, reduced dosing frequency, and improved safety profiles, allowing for transition from intravenous to oral therapy and supporting Japan’s national push toward dehospitalization. Value chain optimization is a growing imperative, particularly among generic manufacturers like Meiji Seika and Takeda, who are investing in process efficiency, biosimilar development, and risk-based quality systems to maintain profitability amid pricing pressures. The hospital and long-term care segment accounts for over 60% of total market value, driven by Japan’s high elderly population and rising incidence of healthcare-associated infections.

Read More @ https://www.polarismarketresearch.com/industry-analysis/japan-antibiotics-market

Pricing dynamics are highly regulated under the National Health Insurance (NHI) framework, which conducts biennial price revisions, creating volatility for manufacturers and favoring companies with diversified portfolios and strong domestic pipelines. Opportunities exist in the development of narrow-spectrum antibiotics guided by rapid molecular diagnostics, which enable pathogen-specific treatment and align with antimicrobial stewardship goals. Additionally, the rise of antibiotic-adjuvant combinations and phage therapy research is opening new frontiers in application-specific growth. A critical trend is the integration of digital health tools—such as electronic prescribing alerts and antimicrobial stewardship software—into hospital workflows, which are improving prescribing accuracy and reducing inappropriate use. As resistance patterns evolve, the market is shifting from empirical to precision-based therapy, reshaping segment-wise performance and favoring companies with robust pipelines and diagnostic partnerships.

0 Σχόλια

·0 Μοιράστηκε

·6 Views

·0 Προεπισκόπηση