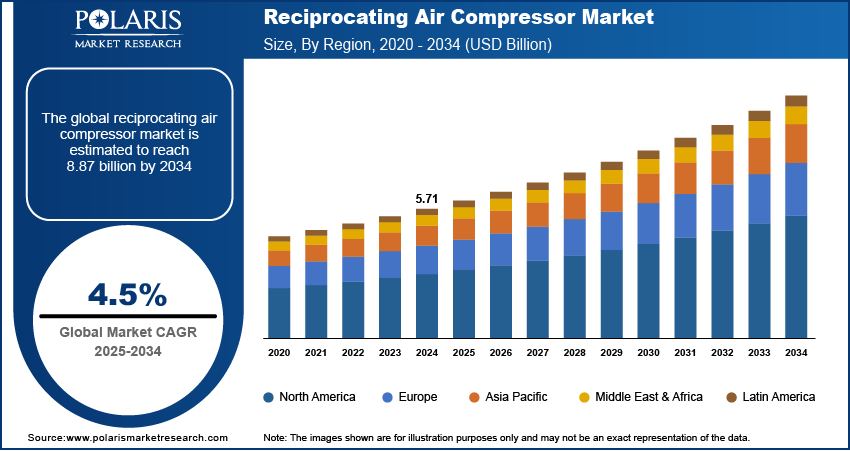

The global reciprocating air compressor market, valued at USD 5.71 billion in 2024, is expected to grow at a CAGR of 4.5% from 2025 to 2034, with segment-wise performance revealing distinct growth trajectories across product types, end-user industries, and applications. The market is broadly segmented into single-stage and multi-stage compressors, with the latter gaining traction due to its superior efficiency in high-pressure applications such as petrochemical processing, natural gas boosting, and industrial painting. Multi-stage units, despite their higher upfront cost, offer better thermal efficiency and lower wear, making them ideal for continuous-duty operations, thereby driving application-specific growth in energy-intensive sectors. In terms of end users, the automotive and general manufacturing industries remain the largest consumers, accounting for over 40% of global demand, according to industry reports from the International Energy Agency and the Association of Equipment Manufacturers. These sectors rely heavily on reciprocating compressors for powering pneumatic tools, assembly line automation, and paint spraying systems.

However, emerging demand is being observed in the food and beverage and pharmaceutical industries, where oil-free reciprocating compressors are increasingly adopted to meet stringent hygiene and contamination control standards. This shift reflects a broader trend toward product differentiation, as manufacturers introduce specialized models with corrosion-resistant materials, advanced filtration systems, and integrated dryers to serve niche markets. Pricing strategies are also evolving, with premium models incorporating digital controls and energy recovery systems commanding higher margins, while entry-level units face intense price competition in developing markets. Value chain optimization is becoming a key focus, as companies streamline production, reduce lead times, and adopt lean manufacturing principles to maintain profitability amid rising material and logistics costs.

Read More @ https://www.polarismarketresearch.com/industry-analysis/reciprocating-air-compressor-market

Another critical trend is the shift toward compact, portable reciprocating compressors for construction and field service applications, where mobility and ease of deployment are prioritized. These units are increasingly equipped with noise-dampening enclosures and fuel-efficient engines to comply with urban construction regulations. Despite these advancements, market restraints include the mechanical complexity of reciprocating systems, higher maintenance requirements compared to rotary compressors, and limitations in continuous operation under extreme loads. However, opportunities exist in the retrofit and replacement market, where aging compressor fleets in mature economies are being upgraded to meet energy efficiency standards such as ISO 50001 and the U.S. Department of Energy’s minimum efficiency regulations.

Innovation in materials—such as composite cylinder liners and advanced valve designs—is enhancing durability and reducing vibration, contributing to longer service intervals. The integration of digital twins and predictive analytics is also enabling condition-based maintenance, reducing unplanned downtime and improving operational efficiency. As industries move toward Industry 4.0 adoption, the role of reciprocating compressors is evolving from standalone equipment to interconnected nodes within smart factories, where real-time data exchange supports energy management and process optimization.

• Atlas Copco AB

• Ingersoll Rand Inc.

• Gardner Denver

• Sullair

• Kaeser Kompressoren SE

• Hitachi Industrial Equipment

• Quincy Compressor

• Fusheng Industrial Co., Ltd.

More Trending Latest Reports By Polaris Market Research:

Fire Suppression System Market

Carbon Credit Market

Air Quality Monitoring Systems Market

Social Platforms for Commerce Market

Otoplasty Market

Cancer Contrast Media Market

Aircraft Catering Vehicle Market

Food Safety Testing Market

Waste Recycling Services Market

However, emerging demand is being observed in the food and beverage and pharmaceutical industries, where oil-free reciprocating compressors are increasingly adopted to meet stringent hygiene and contamination control standards. This shift reflects a broader trend toward product differentiation, as manufacturers introduce specialized models with corrosion-resistant materials, advanced filtration systems, and integrated dryers to serve niche markets. Pricing strategies are also evolving, with premium models incorporating digital controls and energy recovery systems commanding higher margins, while entry-level units face intense price competition in developing markets. Value chain optimization is becoming a key focus, as companies streamline production, reduce lead times, and adopt lean manufacturing principles to maintain profitability amid rising material and logistics costs.

Read More @ https://www.polarismarketresearch.com/industry-analysis/reciprocating-air-compressor-market

Another critical trend is the shift toward compact, portable reciprocating compressors for construction and field service applications, where mobility and ease of deployment are prioritized. These units are increasingly equipped with noise-dampening enclosures and fuel-efficient engines to comply with urban construction regulations. Despite these advancements, market restraints include the mechanical complexity of reciprocating systems, higher maintenance requirements compared to rotary compressors, and limitations in continuous operation under extreme loads. However, opportunities exist in the retrofit and replacement market, where aging compressor fleets in mature economies are being upgraded to meet energy efficiency standards such as ISO 50001 and the U.S. Department of Energy’s minimum efficiency regulations.

Innovation in materials—such as composite cylinder liners and advanced valve designs—is enhancing durability and reducing vibration, contributing to longer service intervals. The integration of digital twins and predictive analytics is also enabling condition-based maintenance, reducing unplanned downtime and improving operational efficiency. As industries move toward Industry 4.0 adoption, the role of reciprocating compressors is evolving from standalone equipment to interconnected nodes within smart factories, where real-time data exchange supports energy management and process optimization.

• Atlas Copco AB

• Ingersoll Rand Inc.

• Gardner Denver

• Sullair

• Kaeser Kompressoren SE

• Hitachi Industrial Equipment

• Quincy Compressor

• Fusheng Industrial Co., Ltd.

More Trending Latest Reports By Polaris Market Research:

Fire Suppression System Market

Carbon Credit Market

Air Quality Monitoring Systems Market

Social Platforms for Commerce Market

Otoplasty Market

Cancer Contrast Media Market

Aircraft Catering Vehicle Market

Food Safety Testing Market

Waste Recycling Services Market

The global reciprocating air compressor market, valued at USD 5.71 billion in 2024, is expected to grow at a CAGR of 4.5% from 2025 to 2034, with segment-wise performance revealing distinct growth trajectories across product types, end-user industries, and applications. The market is broadly segmented into single-stage and multi-stage compressors, with the latter gaining traction due to its superior efficiency in high-pressure applications such as petrochemical processing, natural gas boosting, and industrial painting. Multi-stage units, despite their higher upfront cost, offer better thermal efficiency and lower wear, making them ideal for continuous-duty operations, thereby driving application-specific growth in energy-intensive sectors. In terms of end users, the automotive and general manufacturing industries remain the largest consumers, accounting for over 40% of global demand, according to industry reports from the International Energy Agency and the Association of Equipment Manufacturers. These sectors rely heavily on reciprocating compressors for powering pneumatic tools, assembly line automation, and paint spraying systems.

However, emerging demand is being observed in the food and beverage and pharmaceutical industries, where oil-free reciprocating compressors are increasingly adopted to meet stringent hygiene and contamination control standards. This shift reflects a broader trend toward product differentiation, as manufacturers introduce specialized models with corrosion-resistant materials, advanced filtration systems, and integrated dryers to serve niche markets. Pricing strategies are also evolving, with premium models incorporating digital controls and energy recovery systems commanding higher margins, while entry-level units face intense price competition in developing markets. Value chain optimization is becoming a key focus, as companies streamline production, reduce lead times, and adopt lean manufacturing principles to maintain profitability amid rising material and logistics costs.

Read More @ https://www.polarismarketresearch.com/industry-analysis/reciprocating-air-compressor-market

Another critical trend is the shift toward compact, portable reciprocating compressors for construction and field service applications, where mobility and ease of deployment are prioritized. These units are increasingly equipped with noise-dampening enclosures and fuel-efficient engines to comply with urban construction regulations. Despite these advancements, market restraints include the mechanical complexity of reciprocating systems, higher maintenance requirements compared to rotary compressors, and limitations in continuous operation under extreme loads. However, opportunities exist in the retrofit and replacement market, where aging compressor fleets in mature economies are being upgraded to meet energy efficiency standards such as ISO 50001 and the U.S. Department of Energy’s minimum efficiency regulations.

Innovation in materials—such as composite cylinder liners and advanced valve designs—is enhancing durability and reducing vibration, contributing to longer service intervals. The integration of digital twins and predictive analytics is also enabling condition-based maintenance, reducing unplanned downtime and improving operational efficiency. As industries move toward Industry 4.0 adoption, the role of reciprocating compressors is evolving from standalone equipment to interconnected nodes within smart factories, where real-time data exchange supports energy management and process optimization.

• Atlas Copco AB

• Ingersoll Rand Inc.

• Gardner Denver

• Sullair

• Kaeser Kompressoren SE

• Hitachi Industrial Equipment

• Quincy Compressor

• Fusheng Industrial Co., Ltd.

More Trending Latest Reports By Polaris Market Research:

Fire Suppression System Market

Carbon Credit Market

Air Quality Monitoring Systems Market

Social Platforms for Commerce Market

Otoplasty Market

Cancer Contrast Media Market

Aircraft Catering Vehicle Market

Food Safety Testing Market

Waste Recycling Services Market

0 Commentarii

·0 Distribuiri

·6 Views

·0 previzualizare